Are you struggling for better ROI? Take your time to build a finance and accounting organizational structure for your firm. It helps companies manage their finances effectively. Having this arrangement allows firms to make more informed decisions on their investments. It demonstrates the collaboration between leaders and staff with well-defined reporting lines.

In this article, you will find a ready-made finance and accounting organizational structure that you can edit and use. Also, you will learn about tips and tricks to make organizational charts. So, let’s dive right in.

In this article

Finance and Accounting Organizational Structure

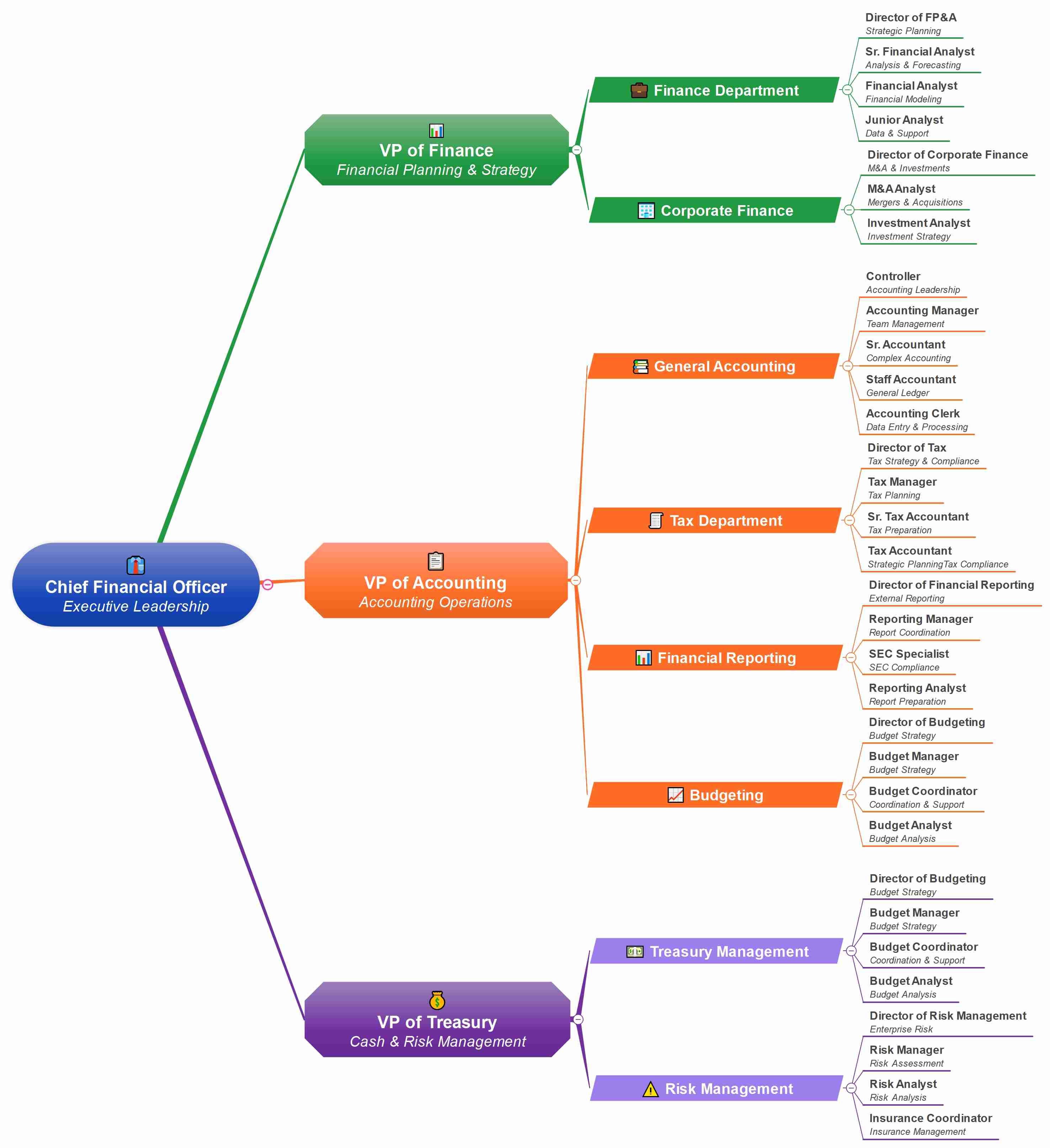

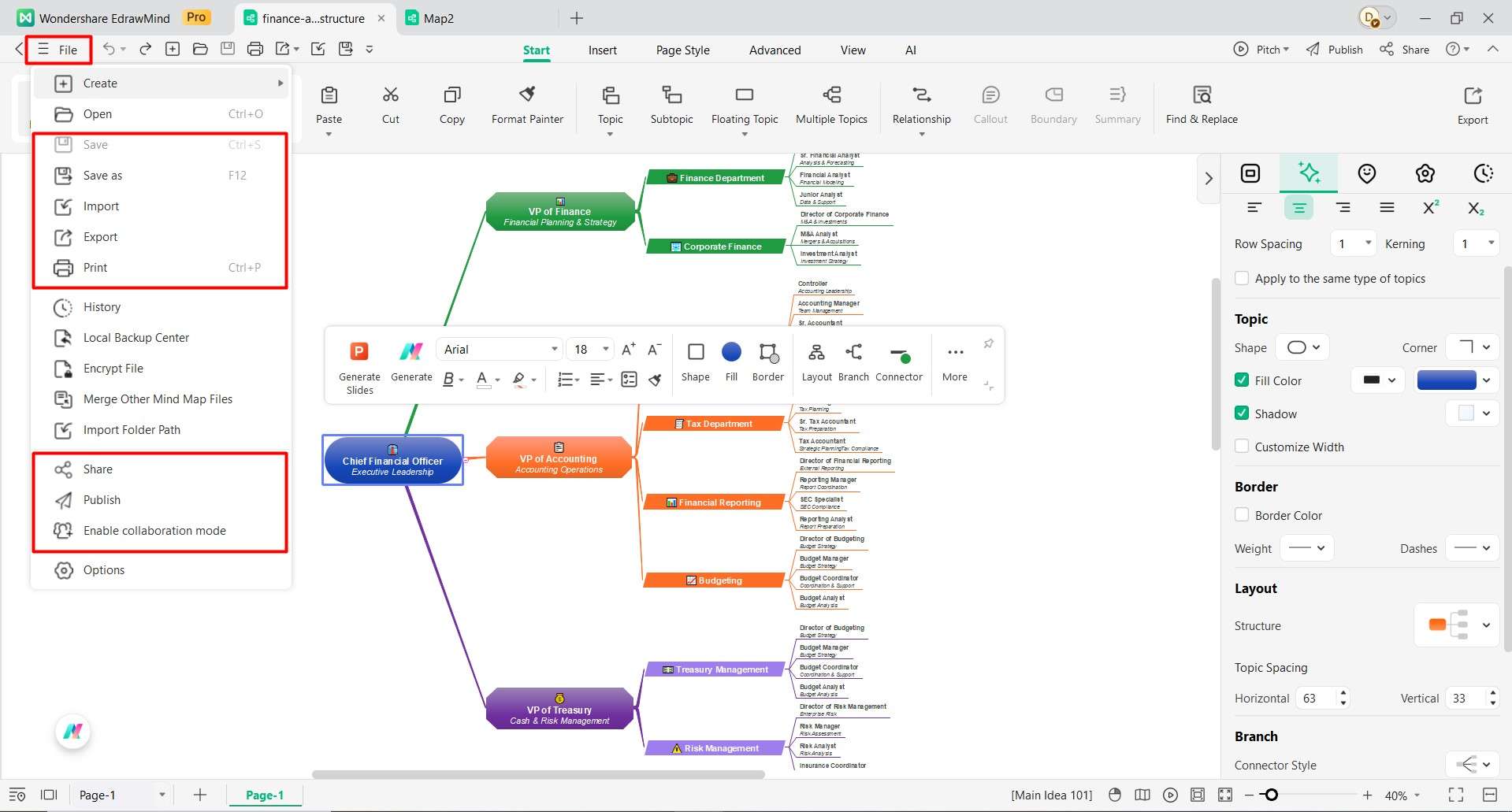

The finance structure looks like a tree. The Chief Financial Officer (CFO) is at the highest level, and he oversees all finance work. Three vice presidents work under the CFO. These VPs work within various areas of the financial sector.

In short, the financial structure consists of three levels. To begin with, the CFO is on the first level; he/she is responsible for making important decisions. There are three VPs on the second level, who handle certain departments. Lastly, the third level contains eight department heads who manage day-to-day activities.

Moreover, decisions flow from top to bottom naturally. The CFO sets goals and plans, whereas the VPs turn those plans into actions with their teams, and department heads ensure that work gets done. This creates clear responsibility at every level.

Executive Team Composition

There are four leaders in the executive team.

- The CFO handles all finance matters like risk and budgets. This person reports to the company's top leaders.

- The VP of Finance handles strategy and planning. This person creates future investment plans. They work with teams that study numbers and predict trends.

- The VP of Accounting handles all accounting activities. He keeps records straight and makes sure to adhere to the country's regulations.

- The VP of Treasury is in charge of cash flow, investment, and financial risk protection.

Weekly, monthly, and quarterly meetings help leaders discuss plans and solve problems together. This collaboration keeps all financial activities aligned and ensures everyone works toward the same goals.

Department Leadership Breakdown

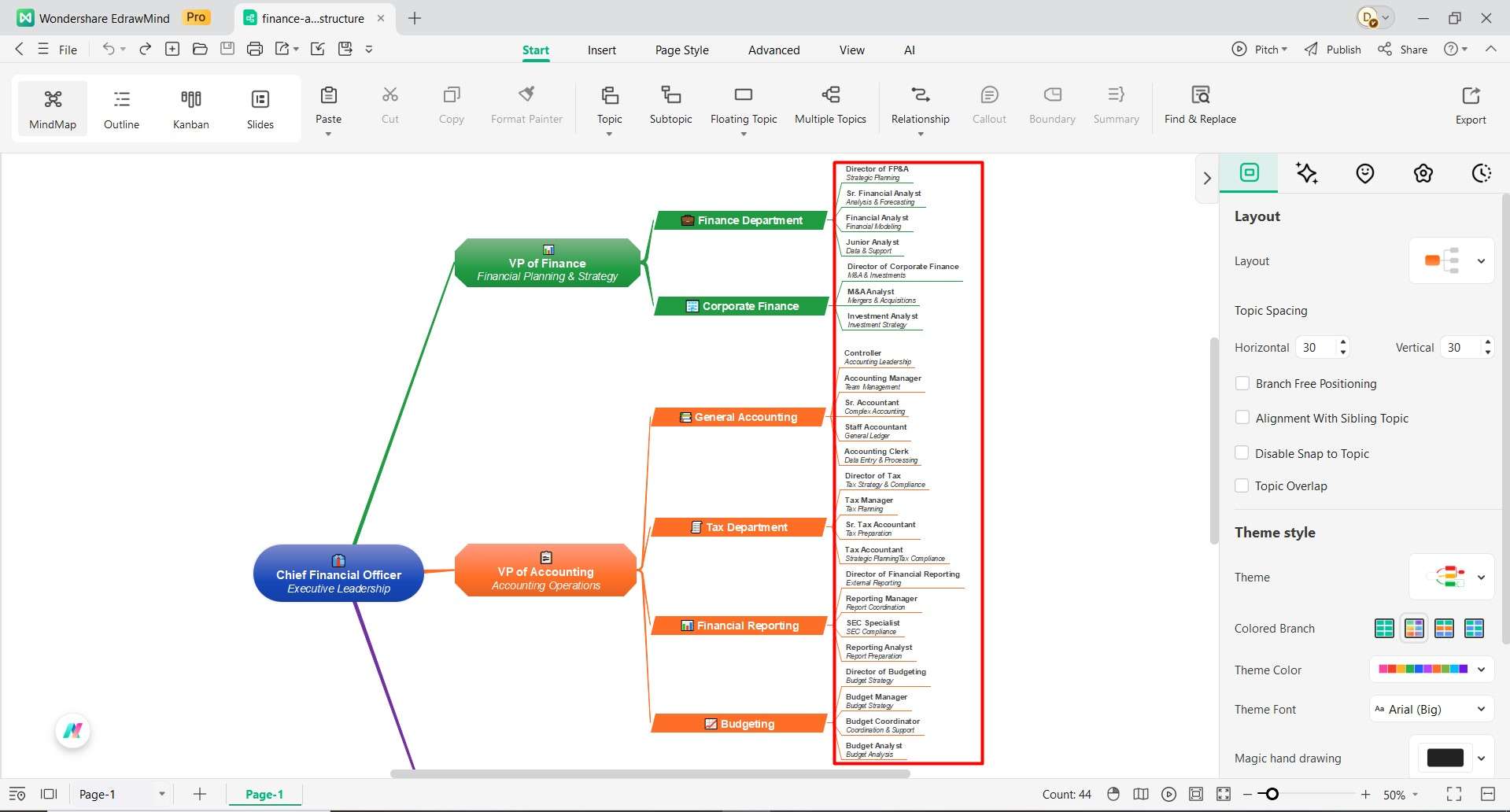

Eight department heads oversee day-to-day operations. Each of them heads a team with particular duties. Let’s understand them.

- The Director of FP&A creates budgets and predicts future cash needs. Financial analysts on their team handle the numbers.

- The Director of Corporate Finance manages large account transfers. This includes buying companies or making significant investments. They have M&A and investment analysts on their staff.

- The Director of Budgeting handles everything related to the budget with the help of budget analysts in their team.

- The Controller operates day-to-day accounting. They have accounting managers, accountants, and clerks to maintain the accuracy of records.

- The Director of Tax makes sure that the company is paying the right taxes. They have accountants and tax managers in their team.

- The Director of Financial Reporting prepares reports to shareholders and the government. They have reporting managers and compliance specialists in their team.

- The Treasury Manager takes care of the daily cash management and makes sure that the company has sufficient cash. Specialists and treasury analysts assist them.

- The Risk Management Director identifies possible issues with money and develops strategies to avoid losses. They are assisted by risk managers and insurance coordinators.

These leaders frequently arrange meetings to get everything organized. They share updates and solve problems between departments. This keeps everyone informed and ready for what's ahead.

Centralized Financial Leadership Model

Strong companies use a Centralized Financial Leadership Model. All financial power comes from the CFO. This person sets the rules for all money matters.

The CFO not only establishes financial policies, but he also approves major decisions to maintain uniform practices and can make fast decisions in case of an emergency. This model is applicable in teams that require strict control. It stops departments from using different rules. It makes leadership clear.

Risk management is also assisted by centralization. The CFO can see all money activities in one place. This helps catch problems early and stop fraud.

Nevertheless, departments can still work daily independently. Directors make regular decisions without consulting. They just consult VPs or the CFO on major decisions. This balance keeps work smooth and controlled.

Why Does this Finance and Accounting Structure Work?

The finance and accounting structure is successful as everybody has definite jobs. In particular, the departments specialize in certain finance activities. This helps teams become experts in their areas. Workers get really good at their jobs.

Also, the three-VP structure allocates work equally. Not a single leader is assigned to look after too many individuals. Rather, every VP has 2-3 departments with which they are familiar. This creates reasonable workloads and better oversight.

In addition, there is a rapid flow of information across the organizational structure. In particular, financial information flows quickly along established reporting channels. As an example, department heads will be able to notify VPs as soon as problems occur. Thereafter, VPs will be able to organize the responses of various teams effectively.

Moreover, flexibility and innovation are also supported by this framework. Specifically, departments can experiment with new approaches in their regions. The structure doesn't block creativity or improvements. This leads to teams adapting to new regulations and changes in the market quickly.

Likewise, there is accountability and efficiency at all levels. Every role has specific responsibilities and performance indicators. Also, performance reviews are naturally based on the lines of reporting. This clarity produces consistent results in all financial work.

Lastly, the design connects the big picture strategy and day-to-day tasks in a seamless way. First, the vision of the CFO is passed on to VPs and working teams. After that, the operations feedback is used to modify the strategies. This two-way communication, therefore, ensures that everyone is on track and responsive to changes.

How to Make a Similar Structure?

Building a finance structure is easier than you think. To create one for your company, begin by knowing what you require from it and who is responsible for certain jobs.

- Name key roles: Name all the key positions in your financial team. Record who reports to whom. This gives you the basic framework to begin.

- Select your tool: Select an easy tool such as EdrawMind, Lucidchart, or Canva. These platforms provide free structure-making templates that are time-saving. Most have drag-and-drop features that make building easy.

- Select a layout: Choose a layout you are comfortable working on. Financial and accounting structures are usually better represented in a hierarchical or tree design.

- Begin from the superior level: Place your CFO or senior financial executive at the top, add VPs below them, and department heads next to them. Link them with straight lines indicating reporting relationships.

- Keep it simple: Separate various departments using different colours. Include only the necessary data, such as names and titles. Do not cram too much text in boxes. Clean design helps everyone understand quickly.

- Test and review: Present your structure to team members. Get feedback and make changes where necessary. Remember to update it as people change positions or new ones are introduced.

Step-by-Step Guide to Create a Finance and Accounting Structure

Make sure, before getting started, you have collected all the relevant information about the finance and accounting department of your company. Once you have all the information collected, choose an easy org chart maker. I have used Wondershare EdrawMind because of its ready-to-use templates and simple interface.

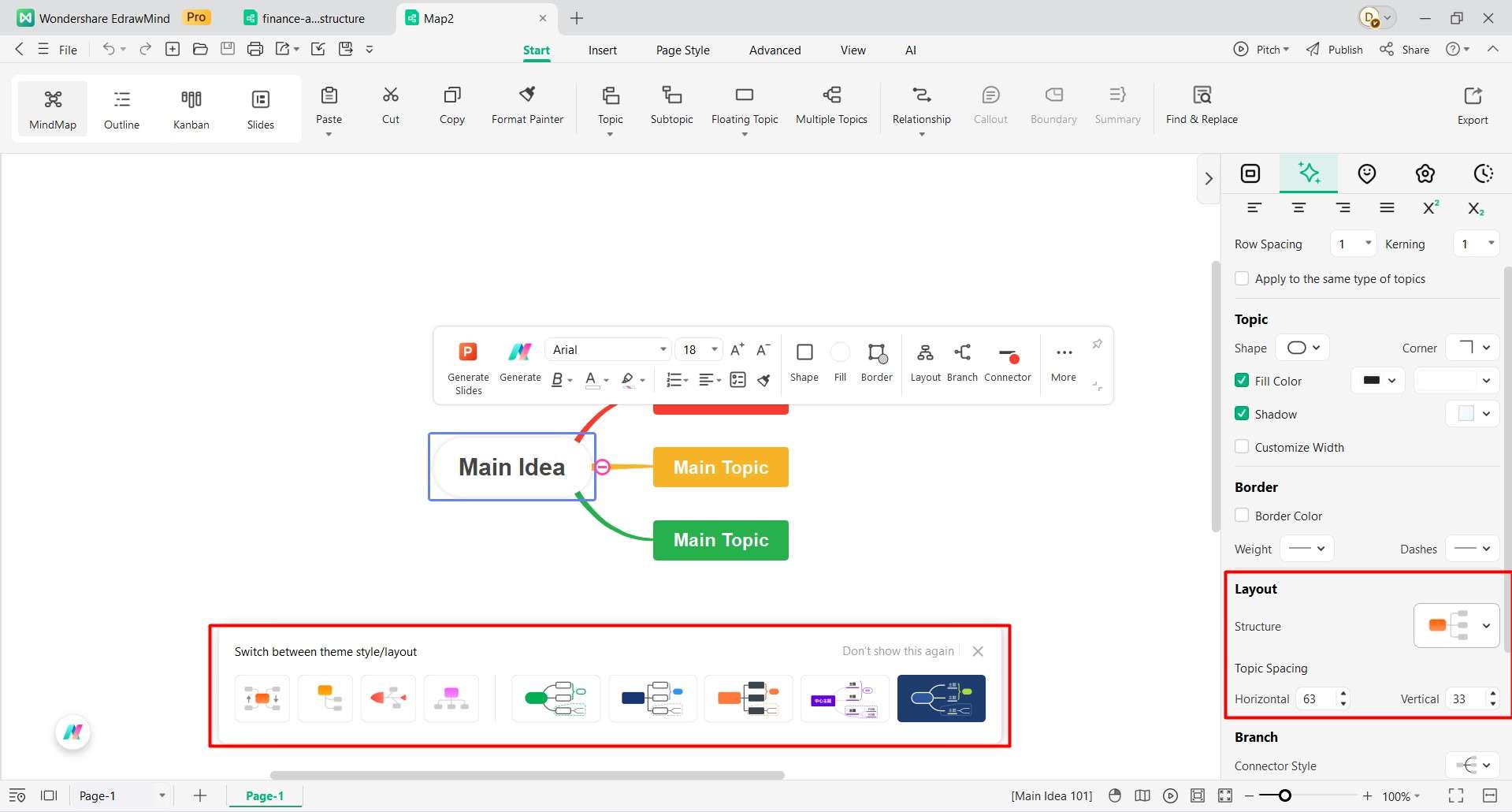

Step1 Start with a New Canvas

- Open the application and create a new mind map.

- Choose a suitable layout and structure from the tool panel.

- I have selected a hierarchical layout that represents a financial structure effectively.

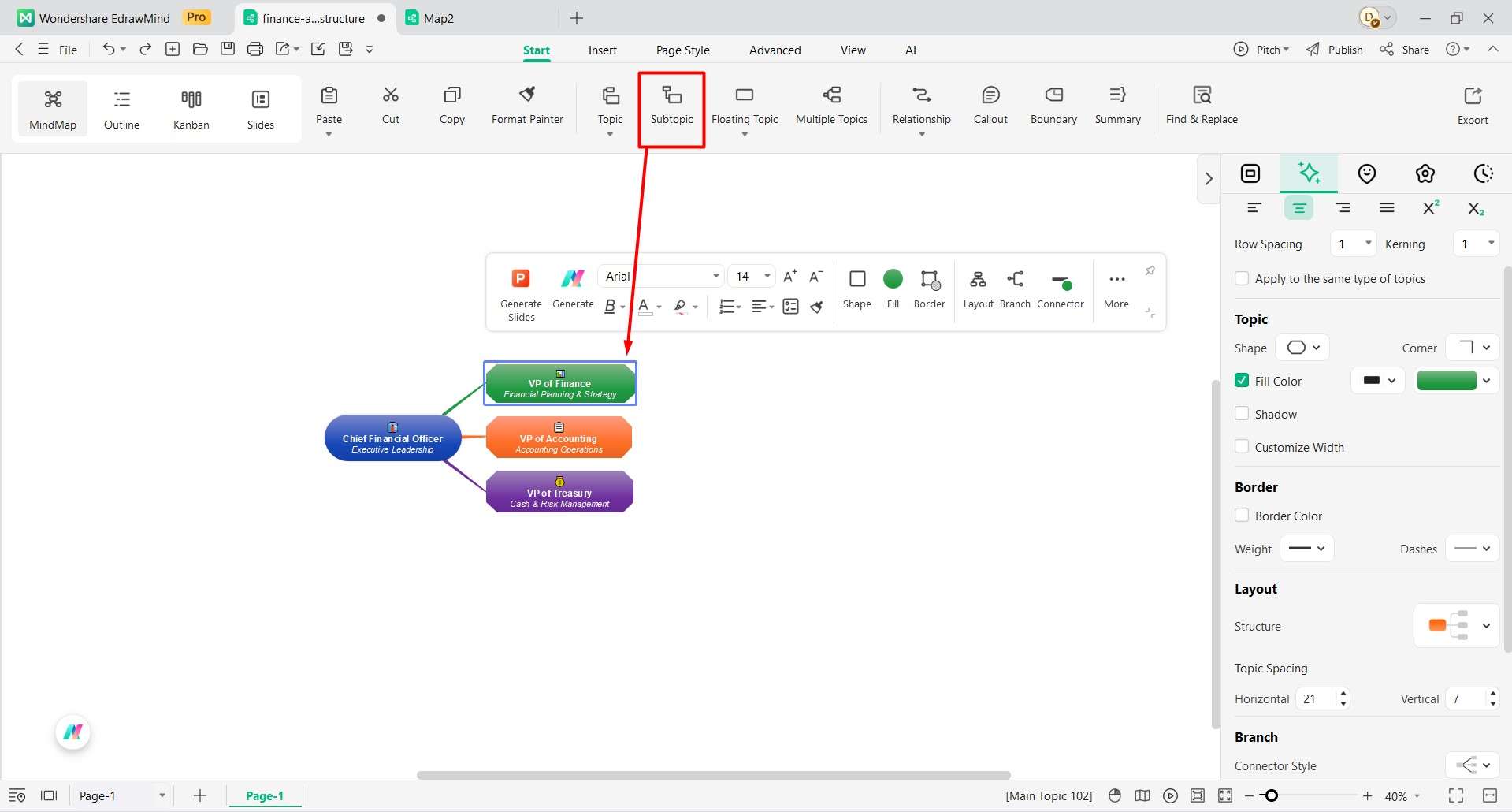

Step2 Identify Top Leadership

- In the Main Idea box, write down the name of the Chief Financial Officer (CFO) of your company.

- Add or remove boxes through Subtopic from the top toolbar. Name these boxes with VP of Finance, VP of Accounting, and VP of Treasury.

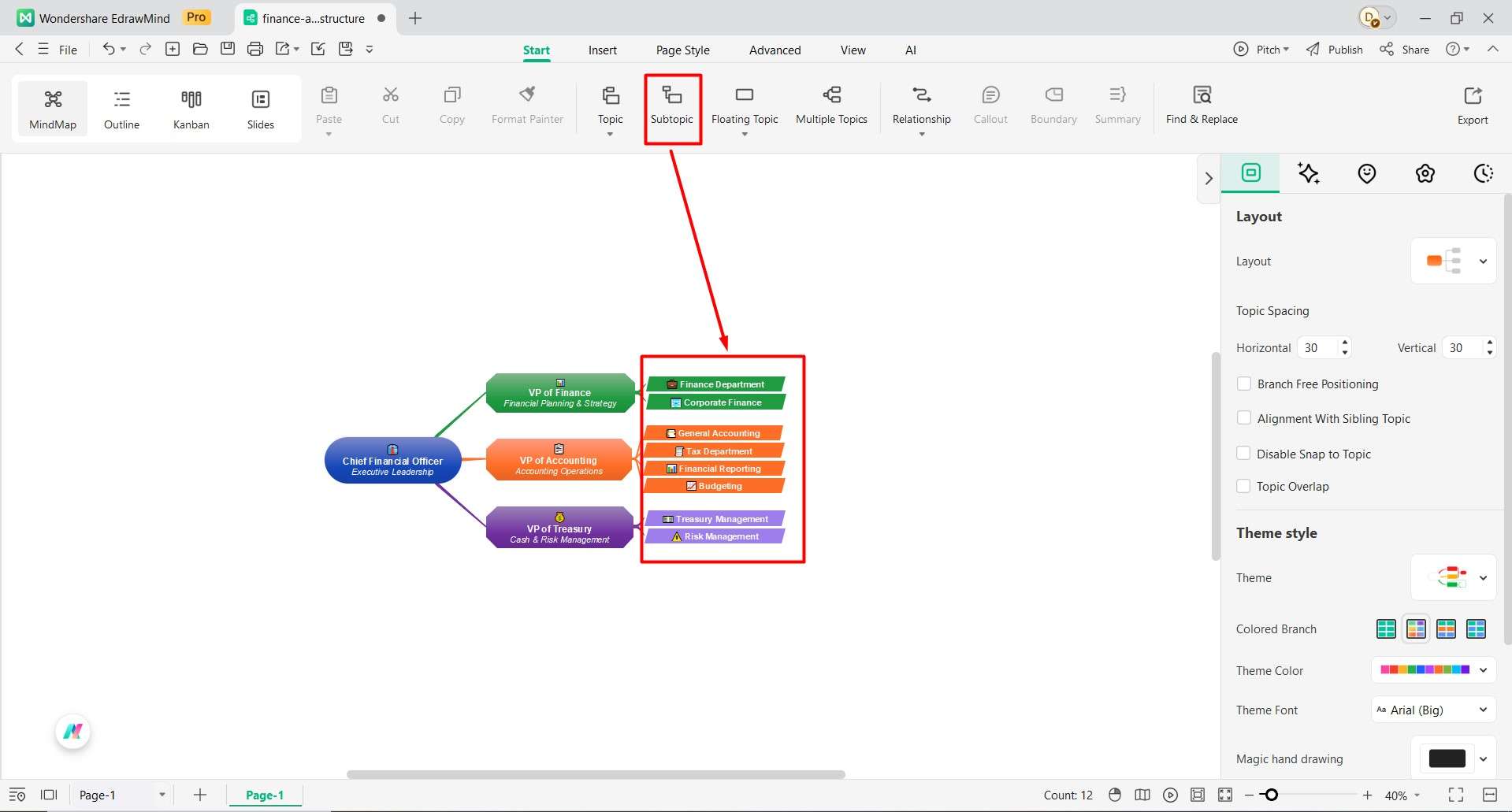

Step3 Add Sub-Departments

- Branch out sub-departments by creating boxes next to each vice president.

- Name them with the finance department, corporate finance, and connect them with the VP of finance. Name boxes with general accounting, the tax department, financial reporting, and budgeting, and connect them with the VP of accounting. Similarly, the VP of Treasury further extends to treasury management and risk management.

Step4 Identify Departmental Team

- Each department contains a specialist team; for this, extend the sub-department and name the roles or positions of those specialists by adding Subtopics.

- It's not necessary to add multiple tiers. Only add those departments that are functional in your company.

- Avoid overcrowding the chart.

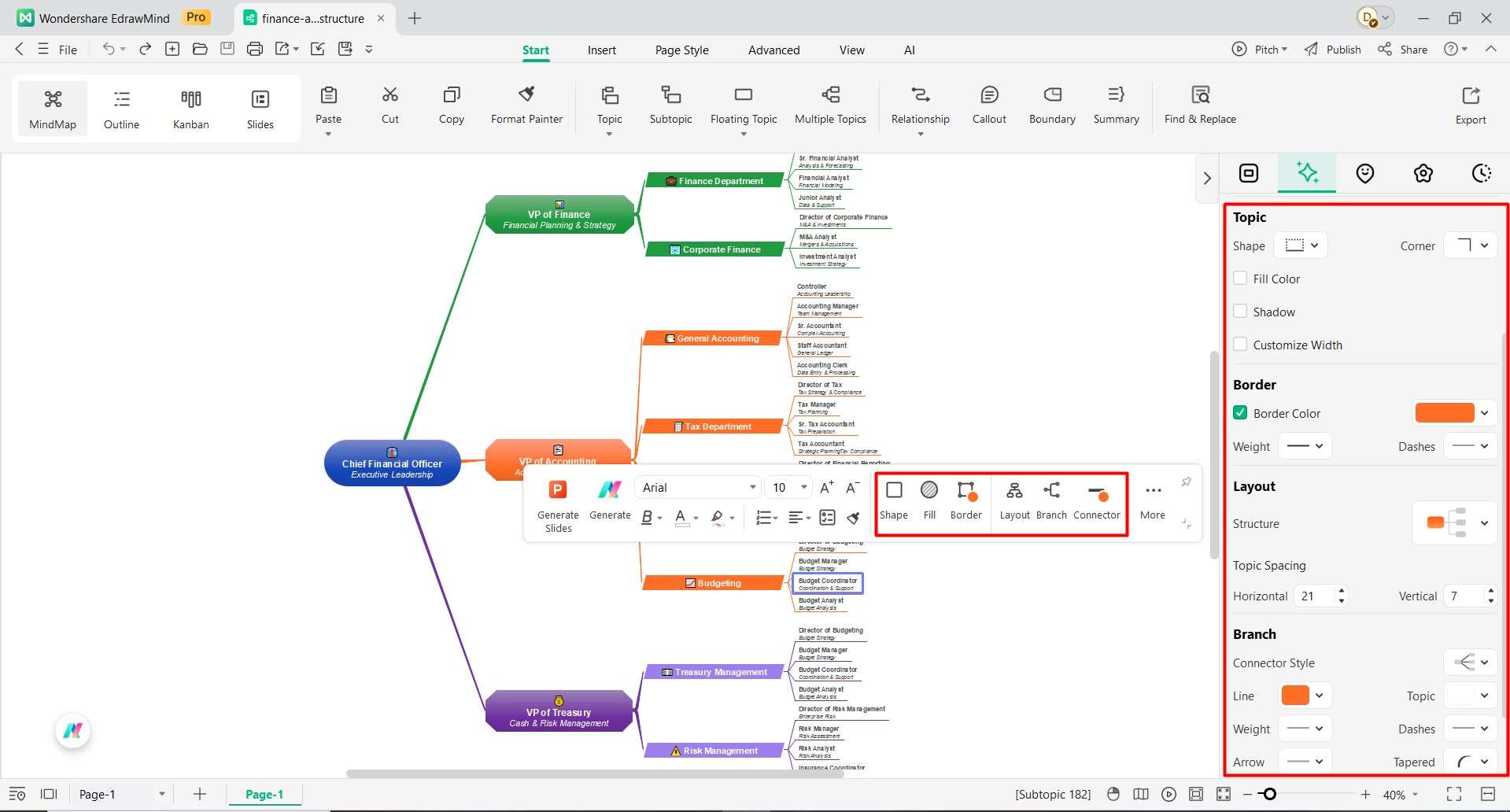

Step5 Check Detailings

- Indicate the differences in the roles of managers, directors, and analysts through different colours and shapes of the boxes.

- Change the shape of the connectors, branches, borders, and branches by navigating the tool panel.

- You can also adopt the same colour theme of your company into the organizational structure to form uniformity.

Step6 Share, Save, or Download

- Carefully check all the names, roles, and their departments.

- Click on the File and choose Export to download as PDF, PNG or Slides.

- You can also share with your team by clicking the share button and copying the link.

Conclusion

A good organizational structure is the basis of financial success. In particular, the finance and accounting framework demonstrates that transparency leads to responsibility and effectiveness.

In addition, this design separates specialized work while keeping everyone on track. Any business can use these ideas to build better financial teams. Make your own finance & accounting structure today for effective communication, quicker decision making, and improved financial performance for your business.