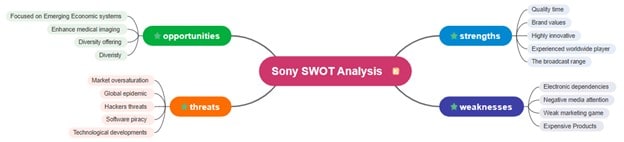

Sony's SWOT analysis separates all of its primary strengths, weaknesses, opportunities, and threats, allowing it to climb to new heights.

In this article

Overview of SONY

Sony is a global powerhouse in three areas: electronics, gaming, and entertainment. While most corporations struggle to keep their market share in just one area, Sony has maintained its position in all three for decades.

Only a corporation with considerable experience, skill, and new methods can do this. A Sony SWOT Analysis is required to comprehend the company's strengths, weaknesses, opportunities, and threats.

However, before you go into those aspects of SONY, here is a brief overview of information you might want to know as you go about the analysis.

| Aspect | Information |

| Founded | 1946 (as Tokyo Tsushin Kogyo) |

| Headquarters | Tokyo, Japan |

| CEO | Kenichiro Yoshida |

| Annual Revenue | US$89.843 billion (2024) |

| Market Cap | US$175.72 billion |

| Key Products/Services | PlayStation consoles and gaming services, electronics (TVs, cameras, audio), entertainment (music, film, anime), financial services |

| Latest Growth | 36.5% YoY rise in Q1 operating profit |

| Official Website | www.sony.com |

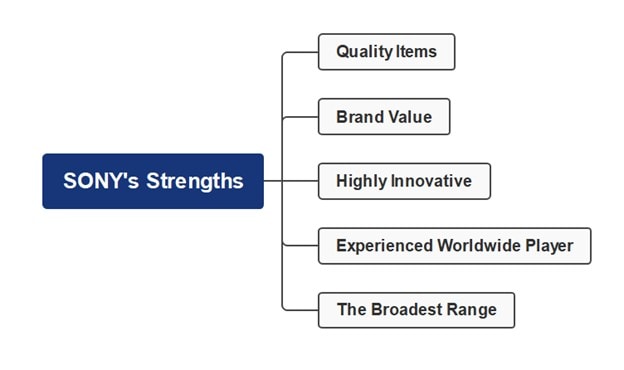

SONY’S Strengths

First, here are SONY’s strengths – the first component of the SWOT Analysis matrix. After this, you should understand that these are the items that make SONY the great corporation that it is right now.

Quality Items

Consistently providing high-quality products is easier said than done when you don't have your consumers' best interests at heart. Sony's massive R&D spending has allowed the business to continually provide high-quality goods.

Brand Value

Sony has been obsessively focused on meeting the demands of consumers from its inception, allowing the business to cultivate a tremendously valued brand. Sony was placed #39 on the Top Regarded Companies list and #60 on the World's Most Valuable Brands list in 2019.

Highly Innovative

Sony is one of the most inventive corporations in the world, having developed or assisted in the creation of several new consumer items. Sony has made significant contributions to the consumer electronics sector.

Experienced Worldwide Player

To compete in the global marketplace, you need to be not only highly competitive and sophisticated but also to have extensive experience.

In the 1960s and 1970s, Sony expanded into the United States and Europe, becoming a significant global player long before most of its competitors.

The Broadest Range

Meeting the demands of the whole market ensures significant earnings and long-term viability. Sony offers a wide range of consumer products and services, from home appliances to mobile phones and entertainment.

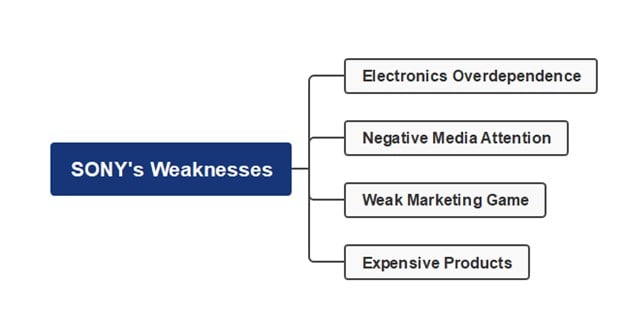

SONY’S Weaknesses

Next up are SONY’s weaknesses. These are internal matters that they need to monitor closely.

Electronics Overdependence

Sony largely relies on electronics, notably televisions, cameras, and smartphone image sensors. Sony's operational earnings fell by 57 percent in the fourth quarter of the 2019/20 fiscal year due to a sharp reduction in electronic demand.

Negative Media Attention

When a corporation is hacked, trade secrets are exposed to rivals, and consumers see ineptitude. Sony was hacked in 2014, exposing vital commercial secrets and straining relationships with other corporations.

Weak Marketing Game

When compared to its rivals, Sony's marketing efforts and promotion strategy are mediocre at best. Consumer goods, regardless of the quality or repute, require extensive advertising and marketing to sell.

Expensive Product

The brand's pricing is a key problem since it is expensive and not always reliable. Countless people worldwide are still unable to purchase Sony items due to their excessive prices. Customers are more inclined to switch to a less priced or resale-value-rich brand, such as Samsung.

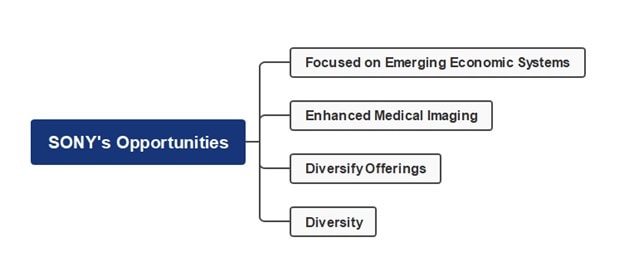

SONY’s Opportunities

Third are SONY’s opportunities. These can pertain to factors or aspects they can leverage to further their strengths or add a new one.

Focused on Emerging Economic Systems

The International Monetary Fund (IMF) predicts that in the following years, emerging markets will expand at a quicker rate of 4.7 percent than developed markets, which will grow at 2.1 percent. Sony is expanding its business in emerging nations to take advantage of rising buying power.

Enhance Medical Imaging

From 2018 to 2025, the healthcare display market is expected to develop at a CAGR of 4.4 percent. Sony is already active in this industry, and all it needs to do now is build its image branch and capitalize on the expected growth.

Diversify Offerings

Despite being a big participant in the game industry, Sony's PlayStation business lacks diversity. For starters, there is a growing demand for mobile games. Sony has the chance to expand its gaming sector by including additional mobile games.

Diversity

Instead of being overly reliant on the consumer electronics business, Sony may use its massive financial resources to purchase promising companies in profitable industries such as software development.

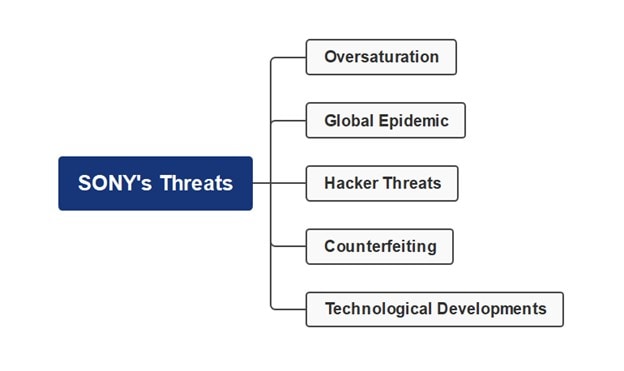

SONY’s Threats

Lastly, here are some threats that SONY will do well to avoid or play against.

Oversaturation

After such an expansion in the number of smartphones led to oversaturation, Sony Mobile was forced to quit Southeast Asia. The demand for and profitability of Sony's products will continue to decline as more businesses enter the market.

Global Epidemic

As a result of the pandemic, businesses all across the world are experiencing poor demand and instability. Sony's operational profit fell by more than 30% in the first quarter of 2020, to its lowest level in four years. If the issue remains or intensifies, the financial harm to the firm may be irrevocable.

Hacker Threats

Any firm is vulnerable to the danger presented by hackers, which can result in millions of dollars in damages and litigation. Sony Pictures knows how a data leak may have far-reaching implications.

Counterfeiting

Fake goods account for 3.3 percent of global trade and are on the rise. Counterfeiters are after high-end items like Sony's TVs, phones, and gaming consoles.

Counterfeiting isn’t limited to hardware. Software pirating can potentially reduce Sony's gaming and associated product sales. As a result, developing solutions to secure the company's software products and profitability rate is critical.

Technological Developments

Over the last decade, technological advancements have enabled newcomers like Techno and TCL to offer elevated quality devices that can rival Sony's but at a lesser cost.

How To Make a SONY SWOT Analysis Diagram

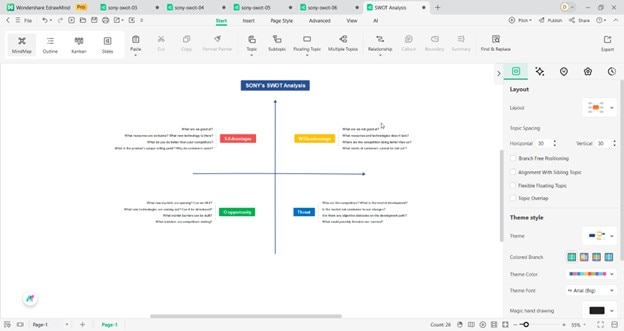

A SWOT analysis is one of the clearest ways to understand Sony’s position in the global market. Instead of going through long lists of information, a diagram helps you see strengths, weaknesses, opportunities, and threats in a structured format.

This makes it easier to identify what makes Sony strong, where it faces challenges, and how external factors could affect its growth. A diagram is simple to read and valuable for presentations, reports, and research.

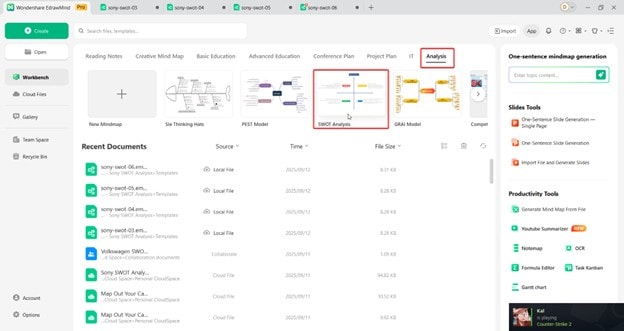

Use a Professional SWOT Analysis Diagram Maker

Making a professional SWOT diagram does not require design skills. With tools like Wondershare EdrawMind, you can create a Sony SWOT diagram in minutes. The software has pre-made templates that require you to add Sony’s details.

You can also customize the layout with colors, themes, and icons to make it easy on the eyes. EdrawMind’s AI tools, such as the diagram generator and built-in chatbot, also help you as you go through all your projects.

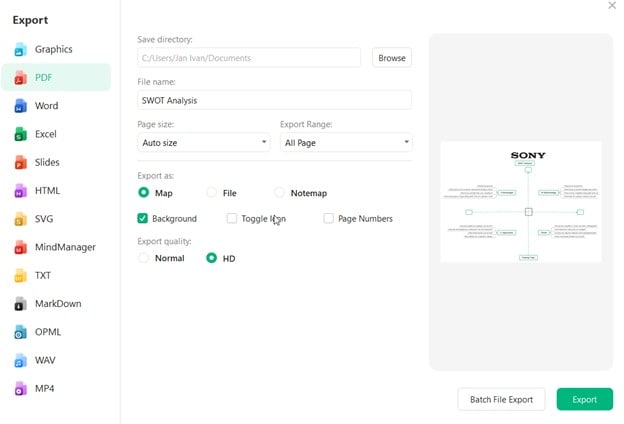

Once finished, you can export the diagram into PDF, PowerPoint, or image formats for easy sharing.

Steps To Make a SWOT Analysis Diagram

Here are the key steps you should follow when making a SONY SWOT Analysis with tools like Wondershare EdrawMind.

Step 1:

First, pick up a SWOT template to save time in manually formatting. In EdrawMind, you can access them from the Analysis tab on the homepage.

Step 2:

Then, add in SONY’s SWOT analysis. For this part, refer to our content above or make one your own (based on your research).

Step 3:

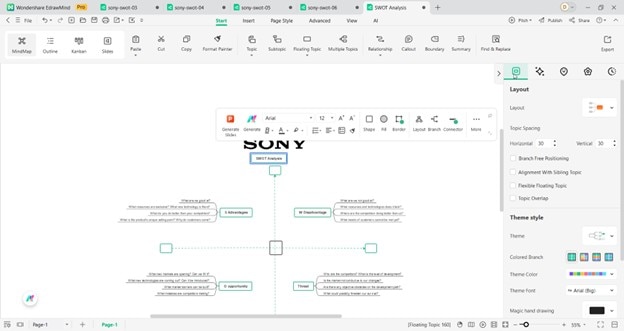

Once done with the content, it’s good to customize your diagram a bit. Add the SONY logo, change the color of shapes, fonts, or make other relevant changes.

Step 4:

You should share your SWOT diagram with your friends. EdrawMind supports various file formats, including PPT, JPG, PDF, and more.

Tips When Making a SONY SWOT Analysis Diagram

For the penultimate part of our article, here are some tips you can follow as you go through your diagramming journey. You can use this not just for SONY’s SWOT analysis, but also for other companies.

- Be specific with entries. Instead of writing “strong brand,” use “PlayStation dominance” or “leading camera technology.” Specific examples make the analysis more practical.

- Balance all four sections. A strong SWOT analysis gives equal attention to strengths, weaknesses, opportunities, and threats. Avoid focusing too heavily on only one area.

- Highlight key points visually. Use icons, bold text, or color coding to emphasize Sony’s most important factors, such as its leadership in gaming and electronics.

- Keep the wording simple. Use short keywords or phrases that are easy to scan. For example, write “streaming competition” instead of a long explanation.

- Match Sony’s branding. Incorporate Sony’s blue, black, and white color scheme in your diagram. This makes the analysis look more professional and aligned with the brand.

- Update regularly. Technology evolves quickly. Review your SWOT diagram often to reflect Sony’s latest products, competitors, and market conditions.

FAQs

FAQ

-

1. How does Sony's diverse business portfolio protect it during market downturns?

Sony operates across gaming, entertainment, electronics, and financial services. Each segment responds differently to economic cycles. Gaming might surge while camera sales drop during recessions. Music licensing provides a steady income regardless of hardware performance.

This spread prevents total dependence on any single market. For example, PlayStation profits offset declining TV sales during the smartphone camera disruption.

-

2. Can Sony's entertainment content give it an advantage in the streaming wars?

Sony owns valuable movie studios and music catalogs. Streaming platforms need this content and pay licensing fees. However, Sony lacks its own major streaming service. The company depends on licensing deals rather than direct customer relationships.

This limits control over distribution and pricing. For example, Spider-Man movies generate revenue through multiple platforms, but Sony cannot build exclusive subscriber bases.

-

3. Why hasn't Sony capitalized better on the artificial intelligence trend?

Sony uses AI internally but lacks consumer-facing AI products. The company focuses on hardware rather than software platforms. AI capabilities remain embedded in cameras and audio devices instead of standalone services. Sony misses software service revenue opportunities that competitors capture.

The hardware-first mentality limits platform development. For example, Sony sensors power smartphone AI, but Google and Apple collect the ongoing service revenue.