Accountability gaps frustrate many bank customers.

When a billing error appeared on my business account, it took weeks to settle. Nobody seemed to know who had the authority to fix it. The cause comes from how the system is built.

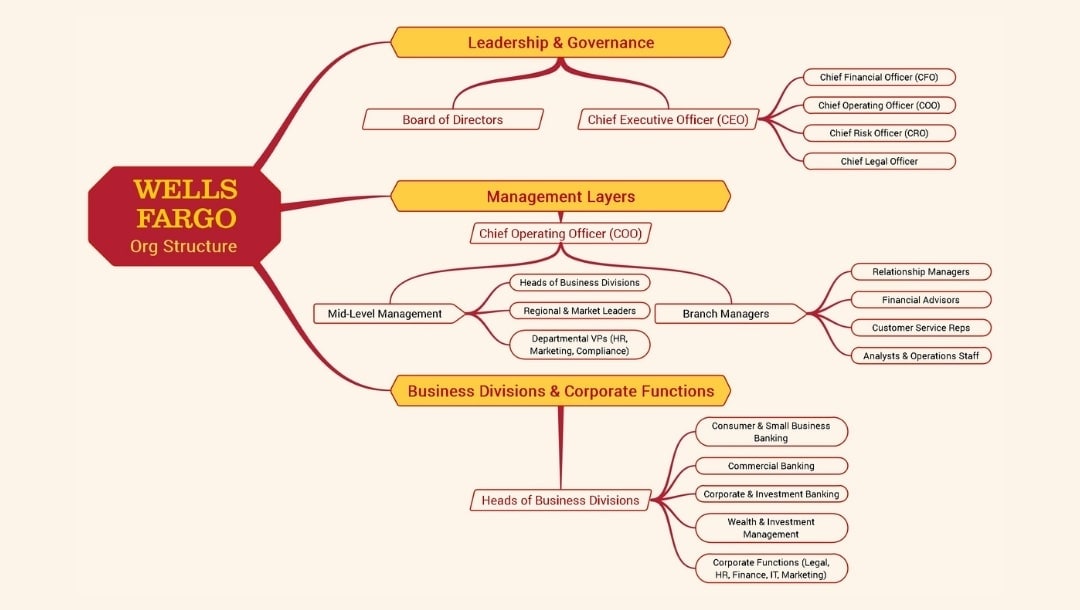

Wells Fargo's organization comprises multiple divisions, each with its own distinct leadership and responsibilities. Knowing its structure can save time when you need a problem resolved.

Here, I'll explore Wells Fargo organizational structure in detail and show you how to design an organizational chart.

In This Article

Wells Fargo Organizational Structure

At Wells Fargo, the organization runs on three layers.

- The board and executives develop the plan.

- Division and regional managers make it work in practice.

- Branch teams deal with customers every day.

This separation builds focus and efficiency across all levels.

Board and Executives of Wells Fargo

Board of Directors

The Board of Directors represents the interests of shareholders. It reviews risk policies, approves large transactions, and holds executives accountable for their actions. When leaders fall short, the board can act.

Chief Executive Officer

The CEO leads the bank's direction. They decide how funds are invested, whether to expand lending, or when to leave slow markets. Also, they nurture trust with shareholders and regulators.

Chief Financial Officer

The CFO controls the bank's financial pulse. They ensure reports are accurate, monitor profit and debt, and maintain strong reserves. Every quarter, they share results with investors.

Chief Operating Officer

The COO carries out steady operations each day. From branches to call centers and IT systems, the entire framework falls under this role. When issues arise, the COO's team handles recovery.

Chief Risk Officer

The CRO acts as the first line of defense against risk. They study loans, market exposure, and systems for early warning signs. If a risk seems too high, they can stop the process right away.

Chief Legal Officer

The CLO protects the bank legally. They manage court cases, track legal changes, and advise leadership. When investigations surface, they work directly with government agencies.

Heads of Divisions of Wells Fargo

Heads of Business Divisions

A division’s leaders run each division with its own financial plan and customer base. They design products, fix prices, and supervise teams. They compete directly for the budget and resources allocated by the CEO.

Regional and Market Leaders

Regional executives oversee operations in particular states or big cities for Wells Fargo. They manage branches, plan workforce needs, and nurture local ties. Their performance shows up in their region's deposit growth and loan quality.

Departmental Vice Presidents

Functional VPs run bank-wide specialties. Compliance VPs ensure the bank adheres to banking laws. Marketing VPs create campaign plans. HR VPs recruit and develop employees. All VPs support every division.

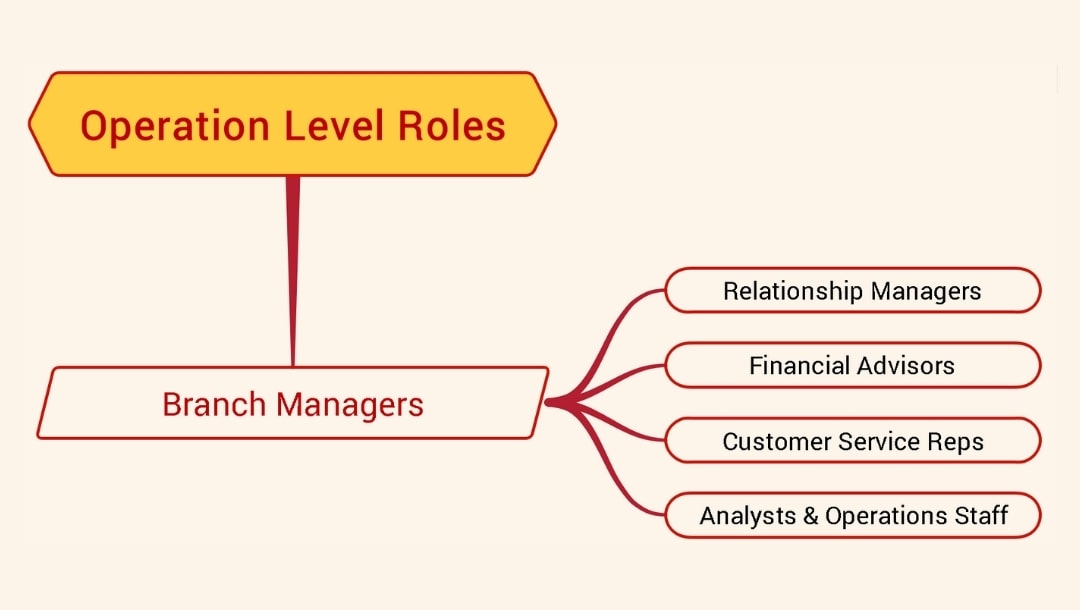

Operational Level Roles of Wells Fargo

Branch Managers

A BM runs daily branch operations. They aim to hit sales targets and handle customer complaints. They approve transactions within established limits and report to regional leaders. Branch sizes range from five to twenty or more people.

Relationship Managers

RMs nurture long-term business relationships with clients. They coordinate services and bring in specialists as required. Their broad support keeps clients loyal.

Financial Advisors

These advisors design investment plans and pick products. They review each client, recommend a suitable portfolio, and track its performance. They must be licensed and operate in accordance with securities laws.

Customer Service Representatives

CSRs handle routine requests: balances, passwords, and account edits. They follow security steps and escalate complex issues.

Analysts and Operations Staff

Analysts check applications, track payments, and prepare reports. Operations staff process many transactions each day. They record activity and verify every entry for accuracy and completeness.

Key Divisions in Wells Fargo

Consumer and Small Business Banking

Through its branch network, the bank serves both personal and small business clients. It provides accounts, credit cards, and loans for homes and cars. It also supports businesses with merchant services.

Commercial Banking

This team partners with established companies to manage credit and cash flow. Their services include credit lines, real estate loans, equipment leasing, and treasury tools. Most clients earn between $10 million and $2 billion in yearly revenue.

Corporate & Investment Banking

Large corporations and government bodies are served here. The team helps raise funds, manage big deals, and handle complex trades. Most of the income comes from service fees.

Wealth & Investment Management

Clients with significant investment portfolios receive full support from this division. It helps manage wealth, handle trusts, and offers private banking services.

Corporate Functions

Core teams support every division. Legal ensures laws and policies are followed. HR manages people and training. Finance reviews performance. IT runs all systems. Marketing promotes the bank's name and image.

How Wells Fargo's Structure Works in Practice

Leadership Activities

All major plans go through approval gates. Division heads propose them, executives review, and the board approves the final draft.

Finance works on a monthly cycle. Teams gather data, and the CFO reviews it before it goes to regulators.

Divisional Activities

Dashboards refresh daily. Division heads track core indicators, loans, deposits, fees, and complaints. Managers are alerted immediately when trends shift.

Hiring happens quarterly. Regional leaders submit staffing needs, and HR closes those positions in 60 days.

Customer Interaction

BMs can handle most service issues directly. They may waive up to $500, adjust interest rates, or push requests faster through the system.

Complaints are handled quickly. Representatives respond within 24 hours or escalate the issue to the next level. Managers get 48 hours to act before regional leaders take over.

Shared Services

IT maintains systems on a weekly basis and notifies teams of any downtime. Every major update is tested separately before release.

Why Wells Fargo Org Structure Works Well

Control at Scale

Branches follow the same rules, cash limits, and approval steps. Daily checklists roll up to dashboards that show where action is needed.

Smart Specialization

Dedicated teams handle lending, payments, and wealth. Shared client records ensure clear communication and prevent data from being lost or overlooked.

Strong Oversight

Each report, business, risk, and audit, stands on its own. Exceptions are tracked monthly, with owners and deadlines noted. Independent testing adds another layer of review.

Built-in Flexibility

New policies start as pilots in a few markets. When results prove steady, changes expand in the next rollout cycle. If issues arise, the update halts and adjusts.

Tip: To find the right contact, follow the tags, product, risk level, and region. The system mirrors that design.

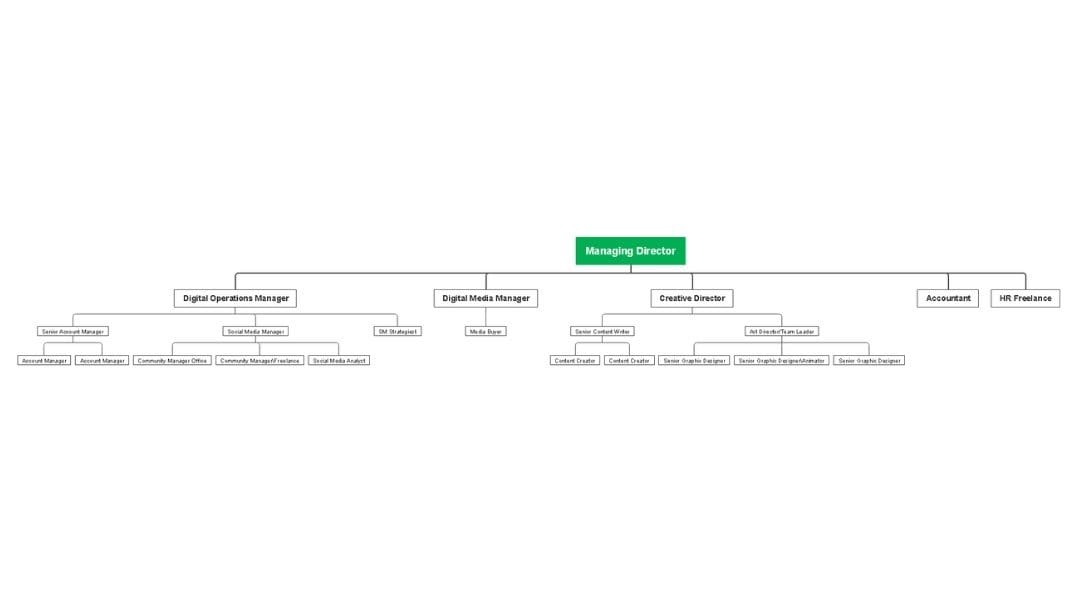

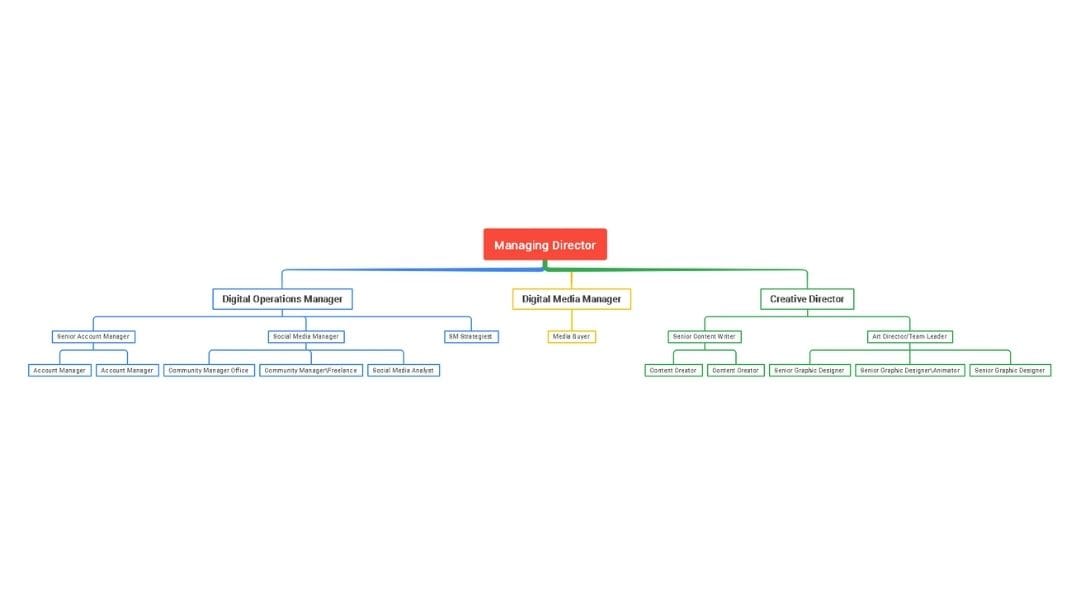

How to Create an Organizational Chart

Making an org chart takes less time than you think. I built my first one in under an hour using simple steps.

Step1 Gather Your Data

- Write down every position title in your organization.

- Note who each person reports to directly.

- Update data and group roles by department to maintain the organization.

Step2 Choose Template

- Open your diagramming software and search for a suitable template that matches your company's size and needs.

- Vertical layouts are most effective when there are multiple management levels.

- Horizontal layouts are better suited for flat organizations with fewer tiers.

Step3 Build from the Top Down

- Place the CEO or owner at the highest point.

- Add executives or department heads in the row below.

- Continue adding managers and their teams in descending rows.

- Use connecting lines to show who reports to whom.

- Delete unnecessary boxes to avoid clutter.

Step4 Refine the Layout

- Align boxes at the same level horizontally for visual clarity.

- Add suitable colors or a theme according to your company

- Adjust spacing so the chart fits on one page when printed.

- Add names, titles, and contact details to each position box.

Step5 Save and Share

- Export as a PDF for easy printing and sharing.

- Download as an image, PNG, or JPEG to integrate in emails or easily share with others.

- Keep the original file for quick updates when staff changes happen.

Last Words

Wells Fargo organizational structure shows how a large bank can manage complexity while remaining adaptable. The layers keep everything organized while departments and regions handle their specific goals.

The same rule can also be applied to your company. A clear structure enables teams to communicate and solve problems more efficiently.

With EdrawMind, you can create org charts in minutes using its ready-made org chart templates and innovative, yet simple, tools.

FAQs

-

How do I mark a vacant role?

Keep the box and write “Vacant” plus the job title. Add a note with the job ID if available. -

Should I put phone numbers or email addresses on an organizational chart?

Avoid personal contact details for privacy. Use names, titles, and a team mailbox if needed. -

How do I show temporary project teams?

Create a small “Projects” area and add the team with a start and end date. Use dotted lines to show temporary oversight.