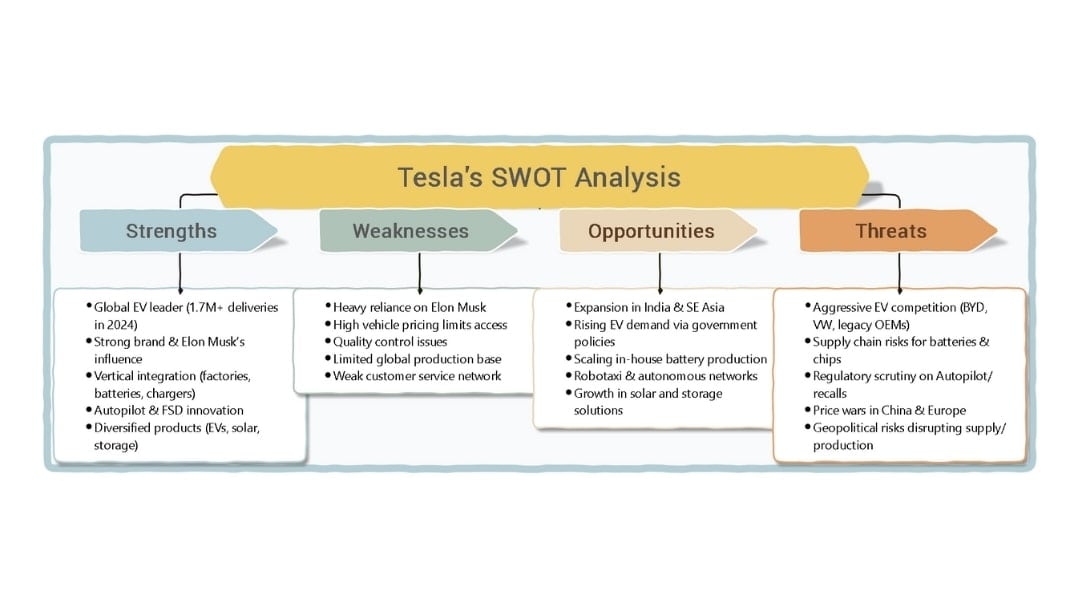

Studying a company like Tesla, I find SWOT analysis the most practical tool to bridge data with real business insight. Rather than sifting through scattered facts, it highlights priorities and explains their significance. Here, I'll explain a SWOT Analysis of Tesla, where internal factors directly connect to external factors.

In this article

Tesla Inc. Overview

Founded

Tesla was founded in 2003 by Martin Eberhard and Marc Tarpenning. Elon Musk, JB Straubel, and Ian Wright joined shortly after and were later recognized as co-founders.

Headquarters

Tesla's headquarters is in Austin, Texas.

Annual Revenue (2024)

In 2024, Tesla generated $97.69 billion in revenue.

Market Capitalization (2024)

By the end of 2024, Tesla's market capitalization stood at about $1.413 trillion.

Global Deliveries (2024)

Tesla delivered 1,789,226 electric vehicles worldwide in 2024.

Employees

As of the end of 2024, Tesla employed 125,665 people globally.

Key Products

Tesla's portfolio includes Model S, Model 3, Model X, Model Y, Cybertruck, Semi, and energy products such as solar and storage solutions.

Recent Growth

- Revenue grew 0.95% year-over-year.

- Deliveries fell 1.07%, marking the first annual decline in over a decade.

- Headcount decreased by 10.54% in 2024 compared to 2023.

Official Website

- tesla.com

- https://shop.tesla.com/

Tesla's SWOT Analysis: Key Parts

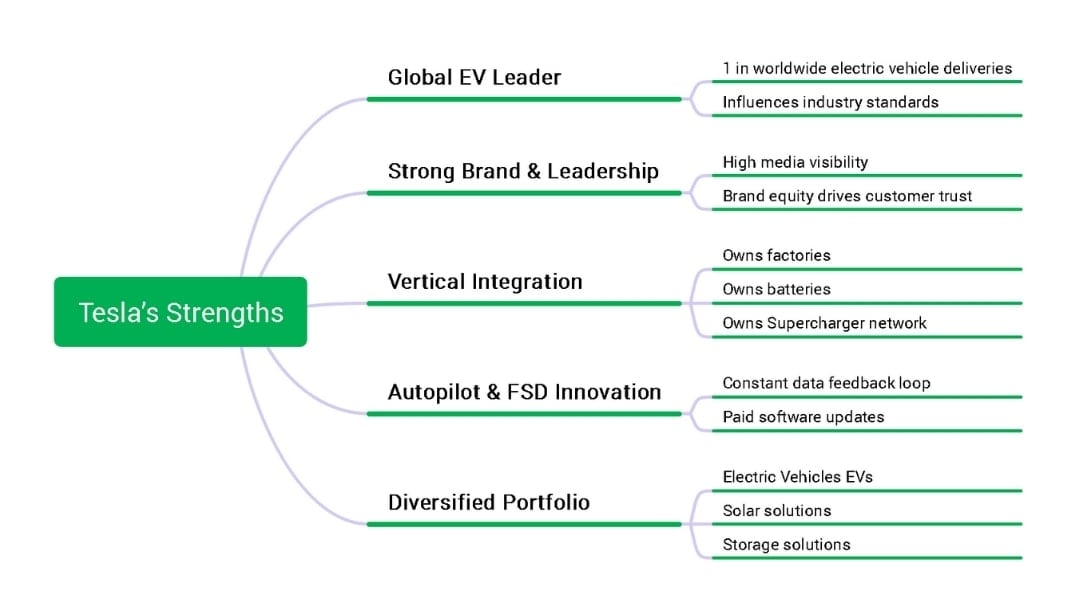

Tesla's Strengths

Global Leader In EV Sales

Tesla's scale in EV deliveries secures priority parts and favorable terms. It also allows Tesla to influence standards that support its charging and software systems.

Strong Brand Reputation And Leadership

Tesla's name and leadership bring strong attention. Linking new launches with easy buying options and using free media helps cut costs and reach new buyers.

Vertical Integration Across Operations

Factories, batteries, and chargers owned by Tesla lower costs and cut waiting times. Standard modules and shared parts speed up building new plants.

Autopilot And Full Self-Driving Innovation

Tesla cars feed constant driving data. More testing, open safety results, and small paid updates turn software growth into steady earnings.

Diversified Product Portfolio

The company offers cars, solar panels, and storage solutions. Bundling these with flexible finance and service options increases customer value and lowers the risk of churn.

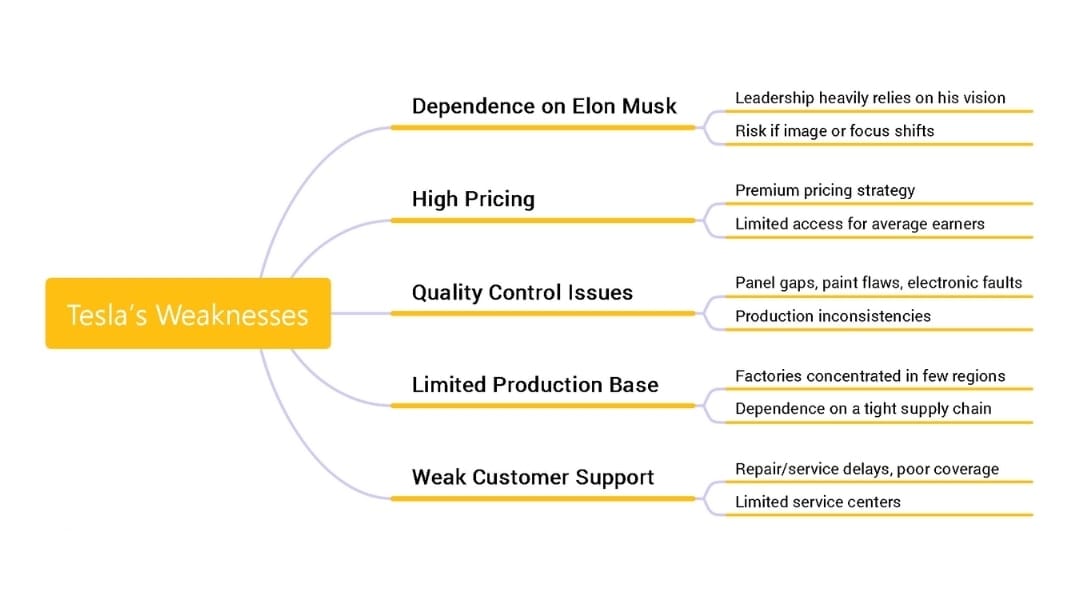

Tesla's Weaknesses

Dependence On Elon Musk's Personal Brand

Tesla depends heavily on Elon Musk's personal image. While it brings publicity, it also creates risk. Negative headlines or a shift in his focus can damage both investor trust and customer faith.

High Pricing And Limited Access

Tesla cars remain costly in most markets. Even the entry models are out of reach for many average earners. This makes it hard to compete with carmakers offering cheaper options.

Quality Control Struggles

Buyers often report problems like panel gaps, weak paint, or electronic faults. Expanding production without addressing these problems can harm the buyers’ trust. It also raises costs due to frequent warranty claims.

Limited Global Production Base

Tesla builds mainly in the U.S., China, and Europe. Its network is smaller than that of Toyota or Volkswagen. This concentration leaves Tesla open to disruptions from local labor or regulatory changes.

Gaps In Customer Support

Service centers remain a bottleneck. Customers often face delays for repairs and parts. These gaps erode customer confidence and hinder Tesla's ability to gain strong loyalty in new markets.

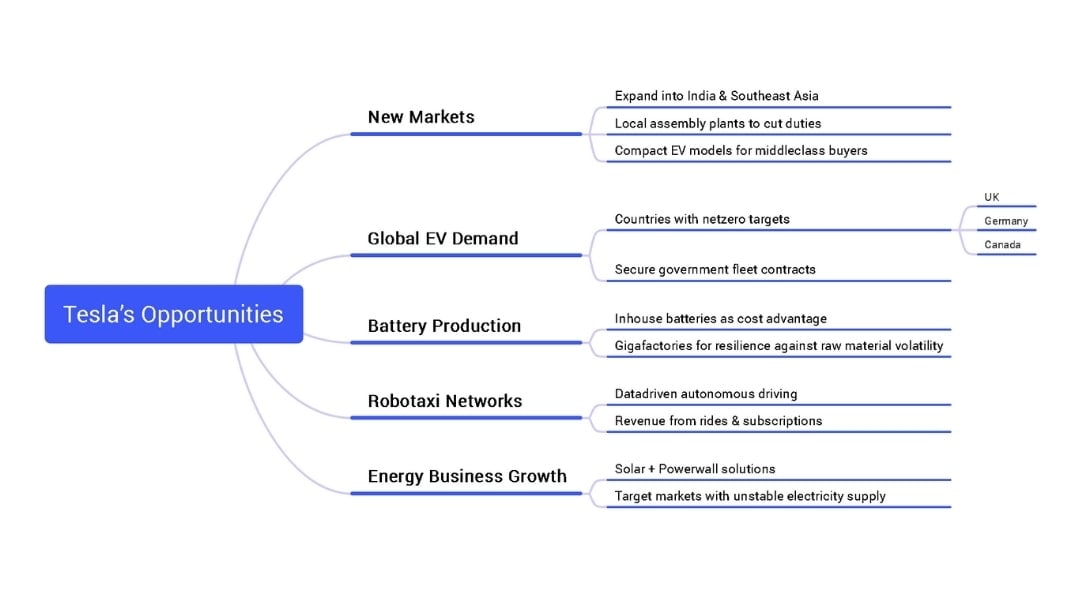

Tesla's Opportunities

Expanding Into New Regions

EV players underserve India and Southeast Asia at scale. Local assembly plants can lower duties, making Tesla models viable for middle-class buyers. Strong demand exists for compact EVs that Tesla has yet to design.

Rising Global EV Demand

Countries including the UK, Germany, and Canada have committed to net-zero targets. These policies act as built-in demand creators for EVs. Tesla can secure contracts by aligning its fleet with such national plans.

Strengthening Battery Production

Tesla's in-house batteries could become its strongest cost lever. Integrating production inside Gigafactories provides resilience against volatile lithium and nickel prices. If scaled, Tesla can get an unmatched advantage over rivals.

Unlocking Robotaxi Networks

Tesla's data-driven approach to autonomy opens a revenue stream beyond car sales. A global fleet of robotaxis would mean income from both rides and software subscriptions. Scaling this service could redefine Tesla's role in mobility.

Growth In Solar And Storage Business

The world's energy problems demand reliable storage. With solar panels, Tesla's Powerwall offers self-reliance from the grid. Nations with an unstable electricity supply are ideal markets. It makes this a natural choice for growth.

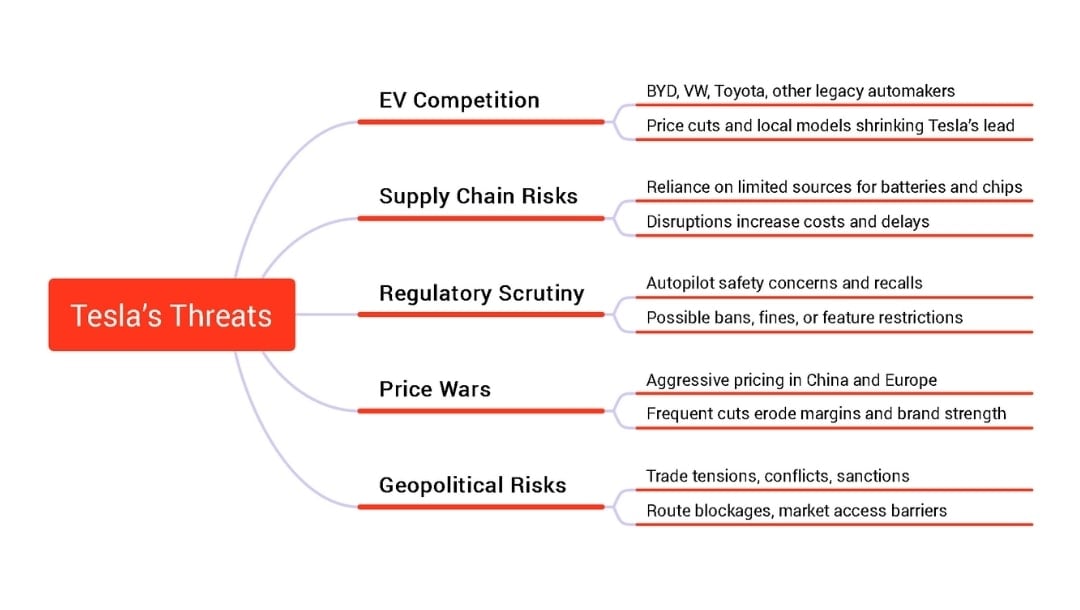

Tesla's Threats

Intense EV Competition

Rivals such as BYD and legacy automakers increase production and lower prices. These moves reduce Tesla's lead in many markets. Focusing on localized models and faster delivery through regional partners can be helpful.

Supply Chain Vulnerabilities

Key inputs for batteries and electronics come from a few countries. Disruption raises cost and delays output. To prevent this, they can secure long-term supply deals, back direct investment in upstream firms, and hold essential spares.

Regulatory Scrutiny On Autopilot And Recalls

Regulators may ban features or require fixes after crashes or safety issues. That disrupts sales and software plans. Creating a transparent safety program, preparing for a rapid recall, and updating processes can mitigate this threat.

Price Wars In China And Europe

Competitors' aggressive pricing forces Tesla into frequent cuts. This erodes its price strength. The fix is cheaper local versions and bundled services to stabilize earnings.

Geopolitical Risks Affecting Production And Supply

Global conflicts or sanctions can shut routes or block markets. Tesla needs risk mapping, supply diversification, and limited local plants to stay resilient.

Practical Tips for a Better SWOT Analysis

Start With Updated Figures

Revenue, deliveries, and production data change quarter by quarter. Use the latest official numbers to keep the SWOT Analysis realistic.

Compare To Competitors

Benchmark Tesla's production cost, charging network, and battery scale with BYD, VW, and Toyota. It highlights where Tesla has a moat and where risks are highest.

Keep Internal And External Clear

When I map a SWOT, I mark "in-company" vs. "market-driven." This ensures quality issues don't slip into the threats box or policy shifts into weaknesses.

Rank By Impact And Urgency

Not all points carry the same weight. Prioritize high-impact issues, such as battery cost volatility or service gaps, over secondary concerns. A simple high–medium–low scale works well.

Connect To Decisions

End every SWOT point with a practical implication: supply risks mean securing contracts, demand mismatches mean adjusting production mix, service gaps mean investing in after-sales.

How to Make a SWOT Analysis for Tesla in EdrawMind?

A visual SWOT Analysis turns Tesla's internal and external factors into a simple view. Strengths link to opportunities. Weaknesses link to threats. It highlights the most critical actions.

If you are interested in creating a SWOT analysis diagram like those above, continue reading to learn how I created them using Wondershare EdrawMind, a free tool for creating various diagrams, including SWOT Analysis.

Steps to Make a SWOT Analysis

Step 1: Start With A SWOT Template

Open EdrawMind and search "SWOT Analysis" in the Gallery. Choose a layout that fits your audience role: a quadrant for internal teams, a circular for board-level slides. Duplicate and rename the template.

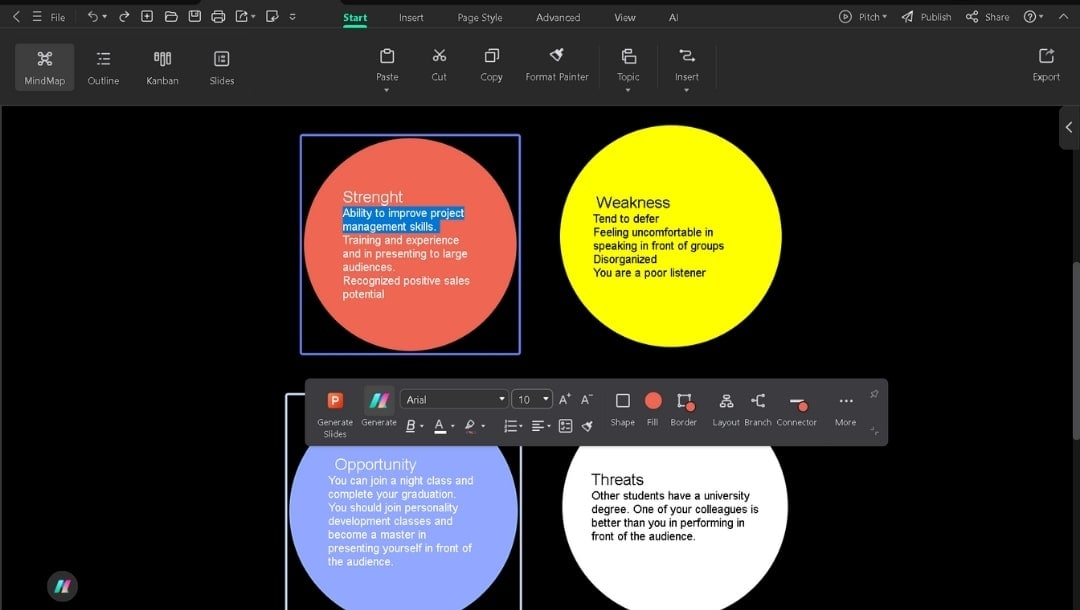

Step 2: Add Tesla's Data

Double-click to add concise bullets to each circle. Keep one thought per line.

- Strengths: Software-defined features, Supercharger footprint, vertical supply links

- Weaknesses: After-sales capacity, quality variance, and leadership concentration risk

- Opportunities: Scale battery cost declines, government fleet contracts, energy storage demand

- Threats: Competitor volume discounts, commodity price spikes, stricter autopilot rules

Mark the top priorities in each circle with a specific color or highlight.

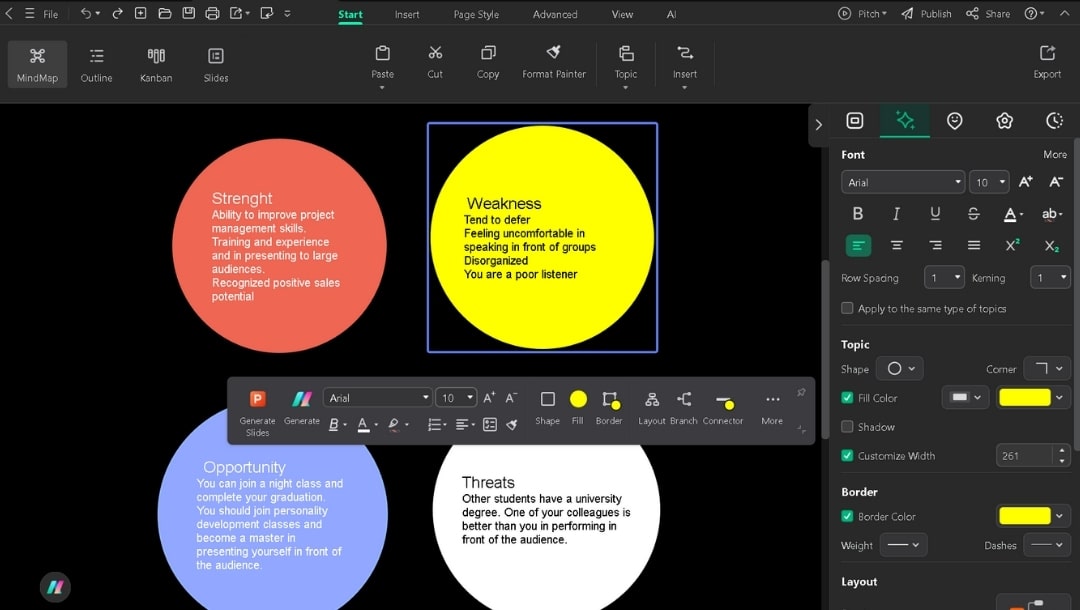

Step 3: Make It Readable

Click any element and use the pop-up menu to change alignment, fonts, and spacing. Select a theme from the right-side panel. Color-code by each factor and add priority numbers next to the top items.

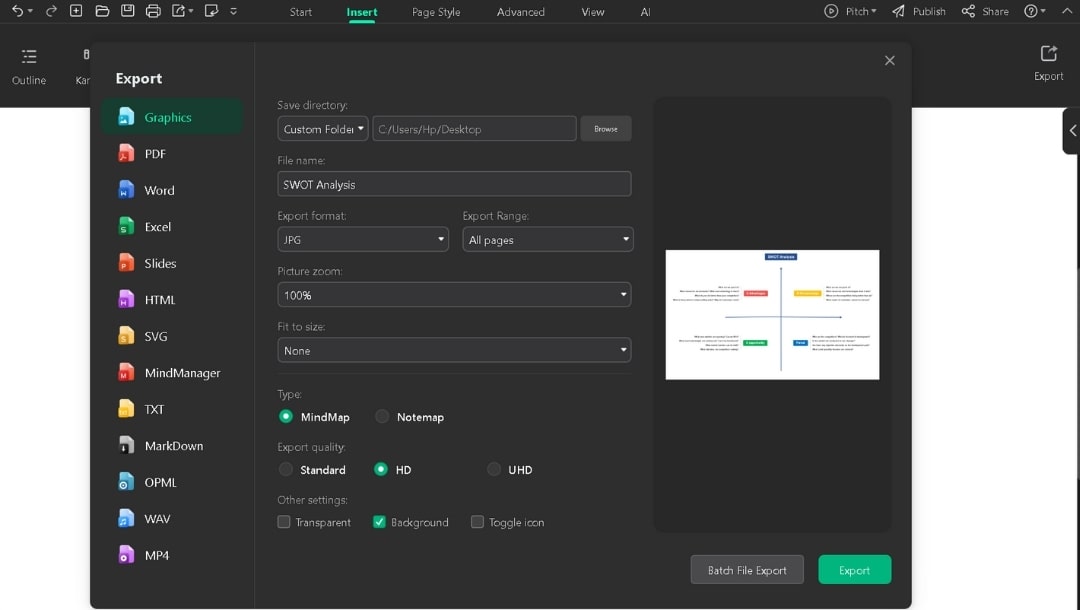

Step 4: Export Or Hand Off

Press the Export button and select the format. Choose a **PDF** for reports or a **PNG** for slide insertion. Use the Share button to create an editable link and set permissions.

Final Words

Tesla stays competitive through innovation and brand strength. Its software features, factory system, and global image drive demand. But high costs and uneven quality stop wider adoption. Growth looks strong with new markets, battery production, and driverless networks. These can expand Tesla beyond cars. Still, rivals, rising costs, and strict rules remain serious risks.

Don’t wait to try EdrawMind for hundreds of professional SWOT templates. Just plug in data and turn scattered insights into strategic visuals.