Porter’s Five Forces helps you see how competition works in a whole market. This model illustrates five external forces that shape how firms compete and earn profits.

In this article

What Are Porter’s Five Forces?

Porter’s Five Forces is a tool to study how tough competition is in an industry. Michael Porter first described it in a famous Harvard Business Review article in 1979. The model helps teams judge market attractiveness and plan strategy.

Instead of looking only at a single company, the Five Forces analyze the entire market. That helps you see where profit is most likely or where price pressure will hurt businesses.

Use it to ask: Is this industry easy or hard to make money in?

The Five Forces: What They Are and Why Each Matters

Bargaining Power of Suppliers

This force asks how much control suppliers have over price and quality. If only a few suppliers exist, they can raise costs. That hurts company profits. Look for supplier concentration, uniqueness of their input, and the cost to switch suppliers.

Why it matters: If suppliers are powerful, firms must pay more or accept worse terms. That lowers margins and can change strategy.

Bargaining Power of Buyers

This force examines how much customers can influence prices or demand more value. Many buyers, including large buyers or those with easy switching options, make them powerful. Check how price-sensitive customers are and whether they can find substitutes.

Why it matters: Strong buyers can demand discounts, higher quality, or special services. Firms must then improve value or cut costs.

Rivalry Among Existing Competitors

Rivalry inquires about the intensity of competition among current companies. High rivalry can lead to price wars, intense advertising, and rapid innovation. Factors include the number of firms, industry growth, and product differences.

Why it matters: High rivalry lowers profits for everyone. Firms need smart positioning or a unique value to stay profitable.

Threat of Substitutes

Substitutes are different products that meet the same need. If substitutes are easy to find or cheaper, customers can switch and pressure prices. Consider performance, price, and customer willingness to change.

Why it matters: Substitutes limit prices and force firms to innovate or improve value.

Threat of New Entrants

New firms entering a market can attract customers and drive down prices. Barriers like patents, scale, brand, or regulation reduce this threat. If barriers are low, expect more entrants and tougher competition.

Why it matters: If new entrants can easily join, incumbent firms must invest in defense by offering better service, lower costs, or stronger brands.

Porter’s model provides a clear view of the external risks and strengths that impact profits. It helps leaders determine whether to enter a market, invest further, or adjust their strategy. Use it to spot where to fight—and where to avoid.

The model also serves as a practical tool for meetings. Teams can fill out each force together, add facts, and prioritize actions. It turns broad ideas into clear next steps.

When Porter’s Five Forces Won’t Be Enough

Porter’s model focuses on the external market and can miss a company’s internal strengths or weaknesses. It can also feel static in fast-changing sectors like tech. Critics note it sometimes oversimplifies complex interactions.

How to complement it:

- Use SWOT to add an internal view (strengths/weaknesses).

- Use PESTEL to track big external trends (laws, economy, tech).

- Add data and customer research to test assumptions. These add depth and reduce guesswork.

Twelve Real-World Examples

Below are 12 examples illustrating how forces are applied in various settings.

Starbucks

Starbucks competes in a crowded coffee market with global chains and local cafés. Strong brand loyalty helps it stand out, but substitutes like tea, energy drinks, and home-brewing keep buyer power high.

Supplier concentration in coffee beans and quality variations affect pricing. Rivalry is intense, and low barriers let small cafés enter easily. Starbucks relies on its scale, customer experience, and branding to reduce these risks.

Apple

Apple thrives in electronics, but the market is fast-changing. Buyers expect premium quality and design, while substitutes like Android devices keep price pressure alive. Brand loyalty limits buyer switching power significantly.

Suppliers of chips and displays hold leverage, raising costs. Rivalry with Samsung and Google is intense. High R&D, patents, and ecosystem lock-in create strong entry barriers, reducing new entrants’ threat.

McDonald’s

McDonald’s faces global rivals like Burger King and Subway. Buyers can easily switch, and substitutes such as home cooking or healthier fast casual dining limit pricing flexibility and increase buyer influence.

Food suppliers are many, keeping their power low. Rivalry in fast food remains fierce, while local entrants open easily due to low costs. McDonald’s relies on brand strength, scale, and efficient operations.

Sony

Sony operates in electronics and entertainment, both highly competitive sectors. Buyers are sensitive to pricing in TVs, consoles, and audio equipment. Rivalry with Samsung, Microsoft, and LG keeps competition strong and continuous.

Substitutes like smartphones replacing cameras and streaming replacing DVDs challenge Sony. Suppliers of key components hold some influence. High R&D costs create entry barriers, limiting new entrants into both electronics and media.

eBay

eBay functions as a global marketplace, connecting millions of buyers and sellers. Buyers hold strong power since price comparisons are instant, and substitutes like direct brand stores or Amazon add further competition.

Suppliers in eBay’s model are its sellers, who rely on the platform. Rivalry from Amazon and niche marketplaces is significant. New entrants face scaling challenges, while network effects still protect eBay.

Walt Disney

Disney dominates global entertainment with strong intellectual property and theme parks. However, substitutes like YouTube, streaming platforms, and gaming take viewer attention, reducing Disney’s ability to command audiences.

Suppliers, such as actors and studios, demand high costs. Rivalry with Netflix, Warner Bros, and Universal is intense. New entrants in streaming exist, but creating original content requires high investment, limiting threats.

Intel

Intel competes in the chip industry, where rivalry with AMD and Nvidia drives innovation. Buyers, like large tech firms, negotiate strongly due to their size and order scale.

Suppliers of rare materials and advanced equipment are powerful. Substitutes like ARM processors threaten traditional chip dominance. Barriers are immense, with fabrication plants costing billions, making new entrants rare and unlikely.

Microsoft

Microsoft commands strong market share in enterprise software and cloud services. Buyer switching costs are high, giving Microsoft leverage, though rivalry from AWS and Google remains strong.

Open-source software provides substitutes, but Microsoft offsets this with integration and features. Suppliers have little power in software. Entry into enterprise cloud requires massive resources, reducing threats from new competitors.

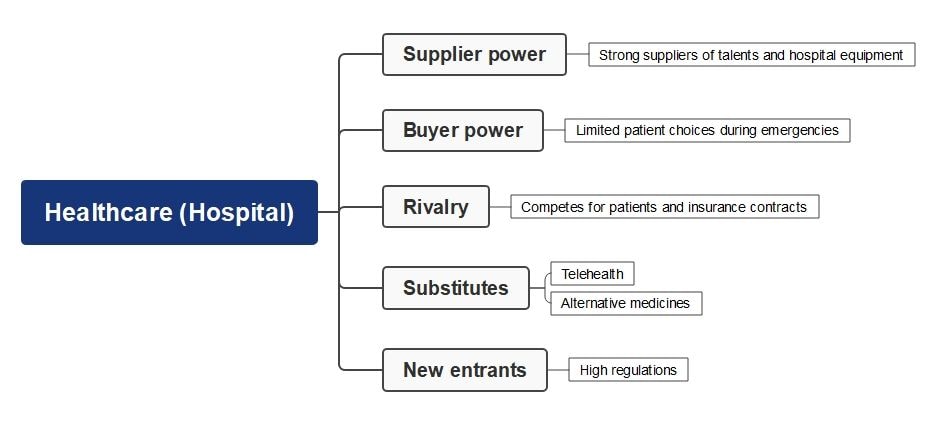

Healthcare

Hospitals face unique dynamics. Suppliers like equipment providers and specialist doctors hold strong power. Patients, however, have limited choices in emergencies, lowering buyer influence in critical situations.

Rivalry occurs among hospitals for contracts and reputation. Telehealth rises as a substitute, offering convenience. High regulation and capital requirements make it difficult for new entrants to enter the hospital industry.

EdTech/Education Platforms

EdTech platforms compete in a rapidly growing market. Buyer power is strong since students can easily switch to free or paid platforms. Substitutes like traditional schools remain powerful alternatives.

Suppliers, including educators and course creators, have leverage if their content is unique. Rivalry is high with Coursera, Udemy, and Khan Academy. Entry barriers are low, enabling new startups to appear quickly.

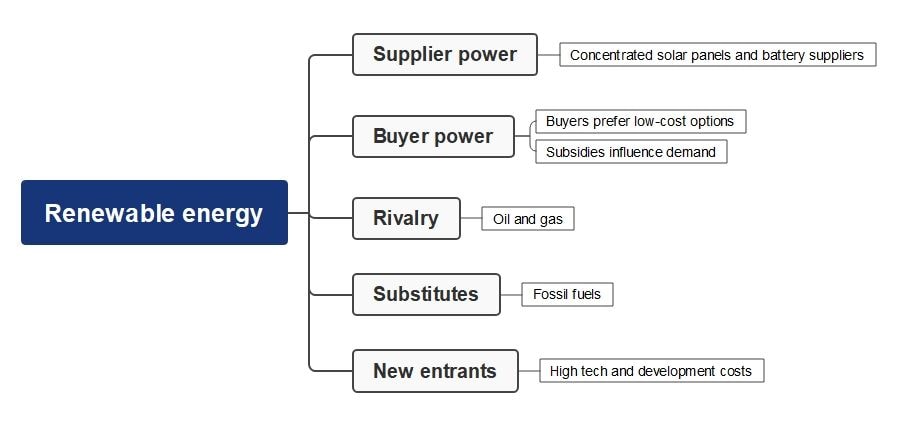

Renewable Energy

Renewable energy faces rivalry with fossil fuels, while buyers want affordable options. Government policies strongly shape demand and industry rivalry, making regulation a key factor.

Suppliers of solar panels and rare materials have significant power. Substitutes like traditional energy sources still dominate in many regions. Entry is encouraged through incentives, but technology costs remain high.

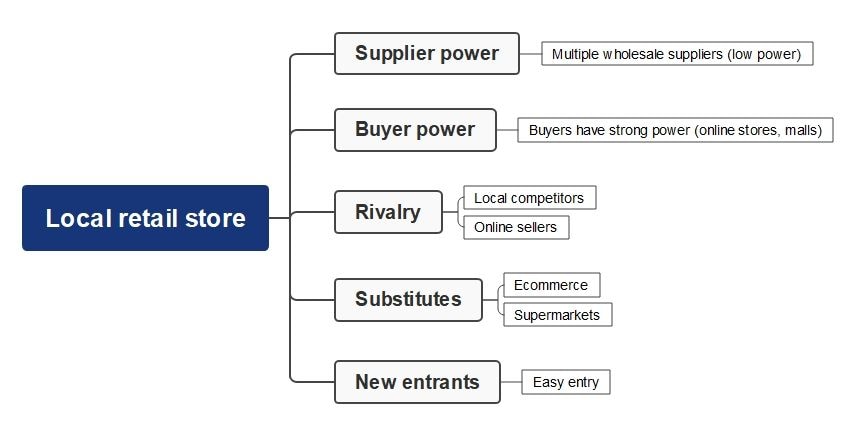

Small Local Retail Store

Local shops face strong rivalry from supermarkets and e-commerce. Buyers hold power due to many alternatives and can easily switch to online stores.

Suppliers are many, keeping their power low. Substitutes like online retail challenge physical shops. Entry barriers are low, meaning new competitors can easily appear in the same area.

Why EdrawMind Is the Best Tool for Porter’s Five Forces Analysis

Wondershare EdrawMind provides ready-made Porter’s Five Forces templates, saving time. Instead of starting from scratch, teams can quickly structure their analysis and focus on insights rather than design.

The tool allows you to add notes, links, attachments, and color codes directly under each force. This keeps evidence, facts, and decisions together in one clear, visual map.

Collaboration is seamless with EdrawMind. Multiple teammates can edit, comment, and refine the analysis in real-time, ensuring that different perspectives strengthen the outcome and reduce blind spots.

Export options make sharing easy. Users can turn their analysis into PDF, Word, or PowerPoint files, making it perfect for presentations, reports, or strategic planning sessions.

How To Build a Porter’s Five Forces Diagram in EdrawMind

Step 1: Create a blank mind map.

- Open EdrawMind and click Create > Blank Mind Map from the dashboard.

- Select whether you want a local file or cloud-based workspace.

- Rename your file immediately for easier organization.

Step 2: Add your industry as the central node.

- Double-click the central node and type the example name and its industry name (e.g., “Starbucks – Coffee retail”).

- Adjust font size or color to make it the main focus.

Step 3: Create the five branches.

- Add branches labeled Suppliers, Buyers, Rivalry, Substitutes, and New Entrants.

- Press Enter to add more main branches, or Tab to insert subtopics.

- You can use colors or icons to differentiate each branch for clarity.

Step 4: Customize your diagram.

- Change the theme or layout to match your preferred style.

- Add images, icons, or links for extra information under each force.

- Use notes and attachments to include supporting data and references.

Step 5: Export and share your work.

- Export the diagram to PDF, JPG, Word, or PowerPoint for easy sharing.

- Share directly with colleagues using links or cloud collaboration.

- Save the file as a template for future Five Forces analyses.

Practical Tips While Building the Diagram

- Define the industry clearly (narrow scope).

- Use data, not guesswork—list facts for each force.

- Rank each force (strong/medium/weak) and explain why.

- Assign one person to gather evidence and one to review the map.

FAQ

-

How many forces are most relevant?

All five matter, but in some cases (e.g., monopoly, heavy regulation), only two to three may dominate. Focus your effort where forces are strongest, not evenly distributed. -

Can I combine Porter’s Five Forces with other tools?

Yes. Utilize SWOT, PESTEL, and competitor benchmarking to analyze internal strengths, the external environment, and broader trends. -

How often should I update the Five Forces analysis?

At least annually, or when major changes occur, such as new regulations, competitor entry, or tech disruption. -

Is it useful for non-profit or public sectors?

Yes. Though “profit margins” differ, forces still apply: competition for funding, substitutes, new entrants (other NGOs), and regulation.