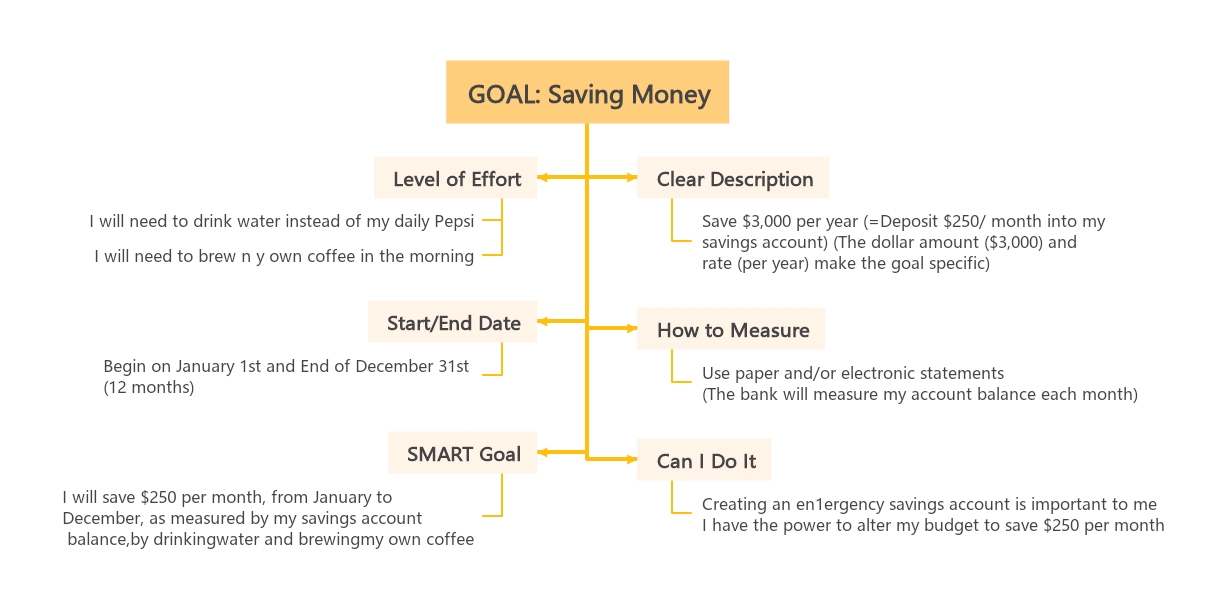

About this saving money goals example template

This template provides a clear framework for planning your financial future. It uses a structured layout to help you define exact saving targets and the daily habits needed to reach them successfully.

Level of Effort

This section outlines the specific lifestyle changes required to meet your savings target. It focuses on small daily choices that add up over time to create significant financial benefits for your household budget.

- Drink water instead of my daily Pepsi

- Brew my own coffee in the morning

Clear Description

A clear description makes your financial goals specific and easy to understand. By defining the exact dollar amount and time frame, you create a concrete target that eliminates confusion during your journey.

- Save $3,000 per year

- Deposit $250 per month into savings

- Use specific dollar amounts and rates

Start/End Date

Establishing a fixed timeline is crucial for maintaining focus and accountability. Setting a beginning and conclusion helps you visualize the duration of your commitment and plan your monthly budget around this specific window.

- Begin on January 1st

- End on December 31st

- Maintain plan for 12 months

How to Measure

Tracking your progress is essential to see how close you are to your objective. This section ensures you have a reliable way to verify your savings through official records and regular monitoring.

- Use paper and/or electronic statements

- Bank measures account balance each month

Can I Do It

Reflecting on your ability to reach a goal builds confidence and motivation. This part addresses the importance of the goal and your personal power to adjust your lifestyle for financial success.

- Importance of creating an emergency savings account

- Power to alter budget to save $250 per month

SMART Goal

The SMART goal section combines all previous elements into one clear statement. It summarizes your amount, timeline, measurement method, and lifestyle changes to provide a final roadmap for your specific saving journey.

- Save $250 per month from January to December

- Measured by savings account balance

- Drink water and brew own coffee

FAQs about this Template

-

How can I stay motivated to reach my yearly savings goal?

Staying motivated requires a clear reason for your financial journey. Remind yourself of the peace of mind that comes with having an emergency fund. You can also celebrate small milestones, like reaching your first five hundred dollars. Using a visual template keeps your plan visible, ensuring you stay focused on your long-term rewards rather than short-term cravings or minor setbacks.

-

Is it better to save a fixed amount or a percentage of income?

For many people, saving a fixed amount like two hundred and fifty dollars per month is easier to track and manage. This approach works well for specific goals, such as saving three thousand dollars in a year. However, saving a percentage of your income is beneficial if your earnings fluctuate. The most important factor is choosing a method that fits your budget consistently.

-

What are the easiest daily habits to change for saving money?

Small daily habits often have the biggest impact on your bank account balance. As shown in the template, replacing branded drinks with water and brewing coffee at home can save hundreds of dollars each month. You can also try packing a lunch instead of eating out or using generic brands. These simple shifts require minimal effort but lead to significant financial growth over time.