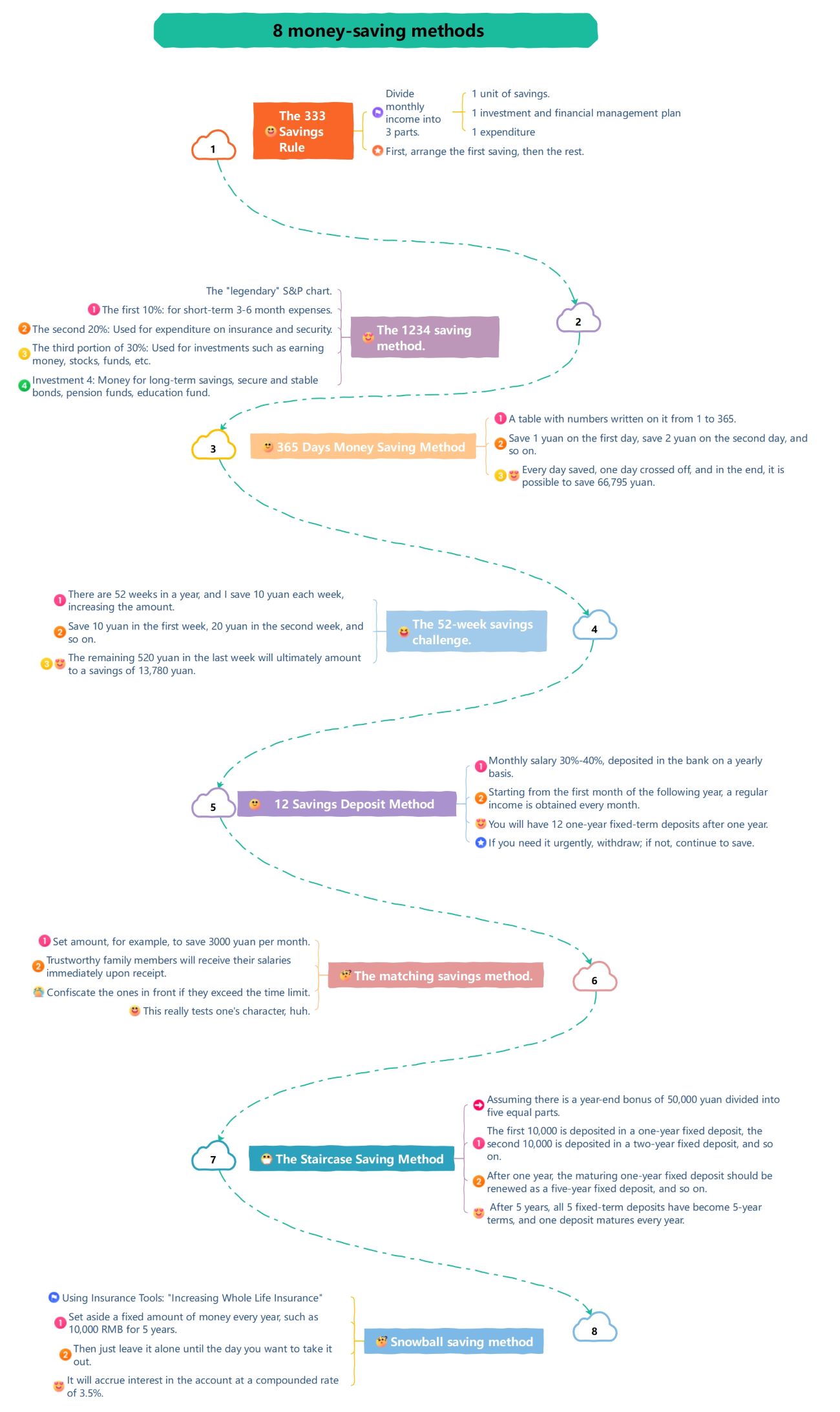

About this money saving techniques template

This template highlights eight unique strategies for managing your money. It provides a visual roadmap for both short-term and long-term saving goals. Use it to track your progress and develop better financial habits every day.

The 333 Savings Rule

The 333 rule focuses on dividing your monthly income into three specific parts. It prioritizes saving before spending to ensure financial stability. This simple approach helps you manage your daily expenses while growing your investments.

- One unit for savings

- One unit for investment and financial management

- One unit for expenditure

- Arrange savings first, then spend the rest

The 1234 Saving Method

This method uses a tiered percentage system based on the famous S&P chart. It covers everything from short-term needs to long-term security. It ensures your money is diversified across spending, protection, and growth categories.

- First 10%: For short-term expenses (3-6 months)

- Second 20%: Used for insurance and security expenditure

- Third 30%: For investments like stocks and funds

- Fourth 40%: Long-term secure savings and pension funds

365 Days Money Saving Method

This technique uses a daily table to help you save consistently throughout the year. You increase the amount slightly every day to reach a significant total. It turns saving money into a rewarding daily challenge.

- Use a table numbered from 1 to 365

- Save 1 unit on day one, 2 on day two

- Cross off one day for every day you save

- Potential total savings of 66,795 units

The 52-week Savings Challenge

This weekly challenge is perfect for those who want to build a large fund gradually. By increasing your savings each week, the process stays manageable. It is an excellent way to save over 13,000 units annually.

- Save 10 units in the first week

- Add 10 more units to the total each week

- Repeat for all 52 weeks in a year

- Final savings amount reaches 13,780 units

12 Savings Deposit Method

This method focuses on creating a ladder of fixed deposits every month. By the second year, you will have a steady stream of maturing funds. It provides both liquidity and interest gains for the saver.

- Deposit 30% to 40% of monthly salary

- Create 12 one-year fixed deposits annually

- Withdraw only if you have an urgent need

- Continue to save and renew deposits regularly

The Matching Savings Method

This method relies on accountability and strict discipline to reach your goals. It involves setting a fixed monthly target and involving a trusted person. This ensures you do not overspend your salary as soon as you receive it.

- Set a fixed monthly savings target

- Have family members hold your salary upon receipt

- Enforce limits on spending beyond the time limit

- Tests your character and commitment to saving

The Staircase Saving Method

This technique is ideal for managing large lump sums like year-end bonuses. By staggering your deposits, you ensure that money becomes available every year. It balances long-term interest rates with annual access to your cash.

- Divide a large sum into five equal parts

- Set up staggered fixed deposits (1 to 5 years)

- Renew maturing deposits into five-year terms

- Ensure one deposit matures every single year

Snowball Saving Method

The snowball method uses insurance tools to grow your wealth through compounding. You set aside a fixed amount annually and let the interest accumulate over time. This approach is designed for long-term growth and financial peace.

- Set a fixed yearly amount for five years

- Use insurance tools for compounding growth

- Leave the money alone to accrue interest

- Earn interest at a compounded rate of 3.5%

FAQs about this Template

-

How do I choose the right money-saving method for my lifestyle?

To choose the best method, first evaluate your income stability and your specific financial goals. If you enjoy daily challenges, the 365-day method is great. For long-term growth, consider the snowball or 1234 methods. Start with a simple strategy that fits your current budget, then gradually move toward more complex systems as your financial discipline improves.

-

Is the 52-week savings challenge suitable for beginners with low income?

Yes, the 52-week challenge is highly flexible for beginners. You do not have to start with high amounts. You can adjust the weekly increment to a value that fits your wallet. The main goal is to build the habit of saving regularly. Consistency is more important than the starting amount, helping you develop a disciplined financial mindset over time.

-

Why is the Staircase Saving Method better than a standard savings account?

The Staircase Saving Method is superior because it offers higher interest rates through fixed-term deposits. By staggering your investments, you gain the benefit of long-term rates while maintaining annual liquidity. A standard savings account often has lower rates. This method ensures you always have cash maturing every year, providing a safety net while your total wealth continues to grow steadily.