Although there are many guidelines for successful accounting analysis, learning to account begins with motivation and hard work.

Studying accounting can be pure tedious if the heart is not in it. One important asset when it comes to how to study accounting is the ability to crunch numbers.

Due to the rise in the need for accounting experts, companies are searching for people with accounting expertise. Getting a degree in accounting isn't straightforward, as it requires diligence and hard work.

As in every other area of research, the amount of effort and commitment affects the results. There are some tips and tricks to help with studying for accounting.

In this article

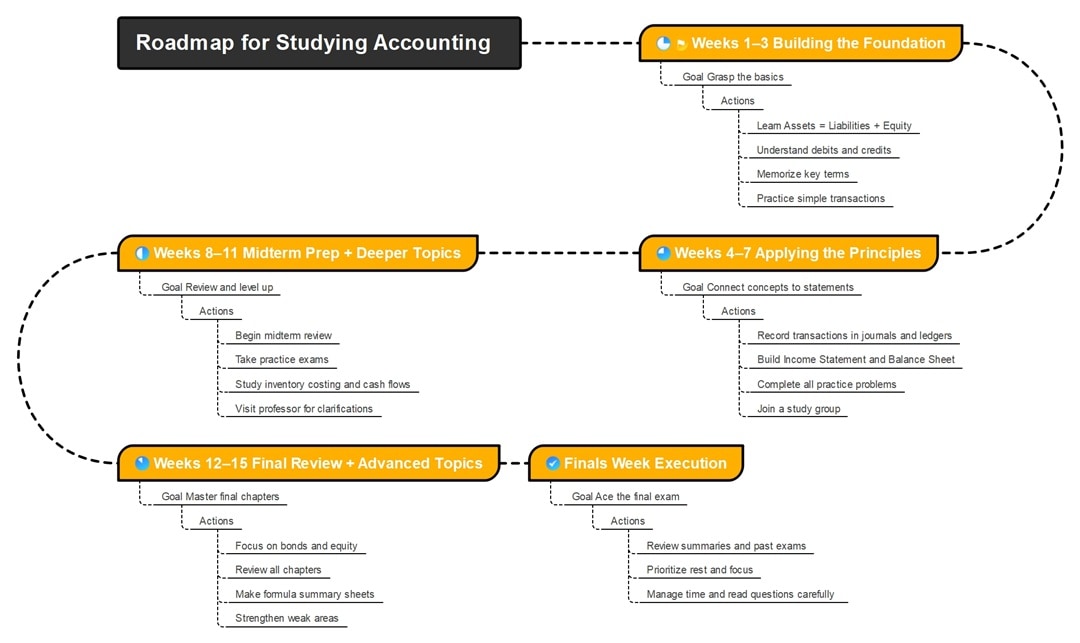

Roadmap to Studying Accounting

Accounting is not a subject that you can memorize its entire content in a short period of time. You do it gradually through a step-by-step process.

This mind map shows you a timeline, the weeks, and the activities. If you closely adhere to it, you will be able to time yourself and stay encouraged throughout the course.

Weeks 1–3: Building the Foundation

Make it a priority to understand the core principles of accounting. Everything else you’ll learn later depends on this part.

- Focus on the core equation: Assets = Liabilities + Equity. This formula shows up everywhere.

- Understand how debits and credits work. Keep practicing until you know exactly where each entry goes without hesitation.

- Build your understanding of key terms using flashcards, especially for concepts like revenue, depreciation, and liabilities.

- Practice simple transactions. Write them out. See how they impact the books.

- Take your time here. Everything else depends on this base.

Weeks 4–7: Applying the Principles

Now it’s time to connect ideas. These weeks are all about moving from theory to application.

You’ll begin recording transactions into journals and posting them to ledgers. You’ll also start learning how financial statements come together. Work on understanding the Income Statement and Balance Sheet by filling them out with mock figures.

It would also be beneficial at this stage to:

- Complete all assigned problems, even the optional ones.

- Solve every practice problem. Even the ones no one checks. Repetition helps things click.

- Form a small study group so you can talk through challenging examples and compare notes.

Weeks 8–11: Midterm Prep and Deeper Topics

The goal now is to solidify what you’ve already learned and push yourself into more complex topics.

- Start reviewing two weeks before the exam. Don’t wait.

- Take practice exams to train your pacing and get used to the question style.

- Go deeper into areas such as inventory costing and the statement of cash flows.

- If any concept feels unclear, visit your professor during office hours and ask questions.

Weeks 12–15: Advanced Concepts and Final Review

Now you pull it all together. Lock in the major topics and review your weak spots.

- Focus on bonds, equity, and anything that gave you a challenging time.

- Review older chapters. You want to see how topics connect.

- Create a summary sheet with key formulas and rules.

- Don’t just reread. Rework problems you got wrong earlier.

Finals Week: Execution

You’ve prepped. Now focus on showing what you know.

During exam week, review your summary sheets and practice questions one last time. Make sure you get enough rest the night before the exam. On the test day, read each question carefully and manage your time with focus.

Preparation matters more than pressure. Stick to your plan and trust your effort.

Resource Recommendations for Studying Accounting

Not all accounting study tools work the same way. Some help you grasp accounting rules, others train you to solve problems fast. You don’t need everything, but the right mix will make a difference.

For Learning and Guides

Need help breaking down tough topics? These resources explain the “why” behind every rule, not only the “how.”

- Textbooks like Financial Accounting by Libby or Weygandt’s Accounting Principles walk you through journal entries, adjusting entries, and financial statements. They also include sample exercises with answers so that you can learn from your mistakes.

- YouTube channels such as Accounting Stuff explain concepts like accruals, depreciation, and the cash flow statement in less than an hour. Visual learners will find these especially helpful.

- AccountingCoach.com offers free breakdowns of topics like balance sheet, bank reconciliation, and standard costing. It also lets you check your understanding instantly with graded quizzes.

For Practice and Tests

You’ll get better by doing. These tools help you apply what you’ve studied, not just memorize it.

- Quizlet lets you drill key definitions and formulas. Create your own deck for topics like the accounting cycle or matching principles.

- Old exams or practice sets help you get used to multi-part questions under time pressure. Solving them also shows you how questions are typically worded.

- CPA review sites such as Becker and Wiley include free review questions that follow a structured format. Practicing with them builds speed and precision.

For Review and Daily Retention

Need help remembering past lessons? Revisiting material regularly helps prevent forgetting. These resources keep your knowledge fresh.

- Podcasts or audiobooks on accounting topics give you another way to review concepts during commutes, so you stay engaged even outside study hours.

- Spreadsheets like Excel help you simulate journal entries, trial balances, or financial ratios. Using them is great for reinforcing the logic behind each number.

Choose tools that make your study time count. Not just easier, but more efficient.

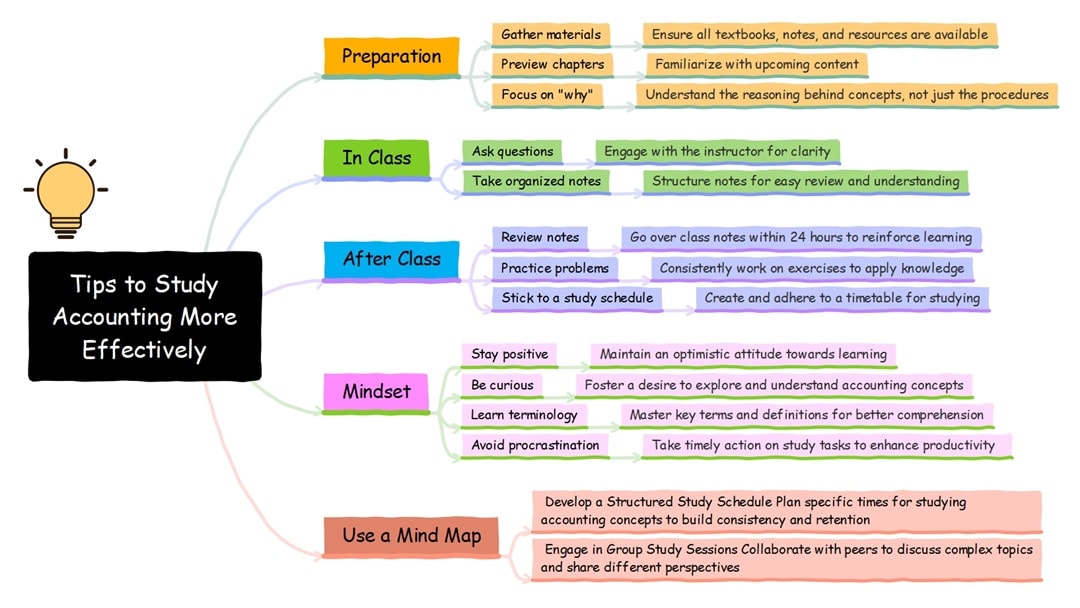

Tips To Study Accounting More Effectively

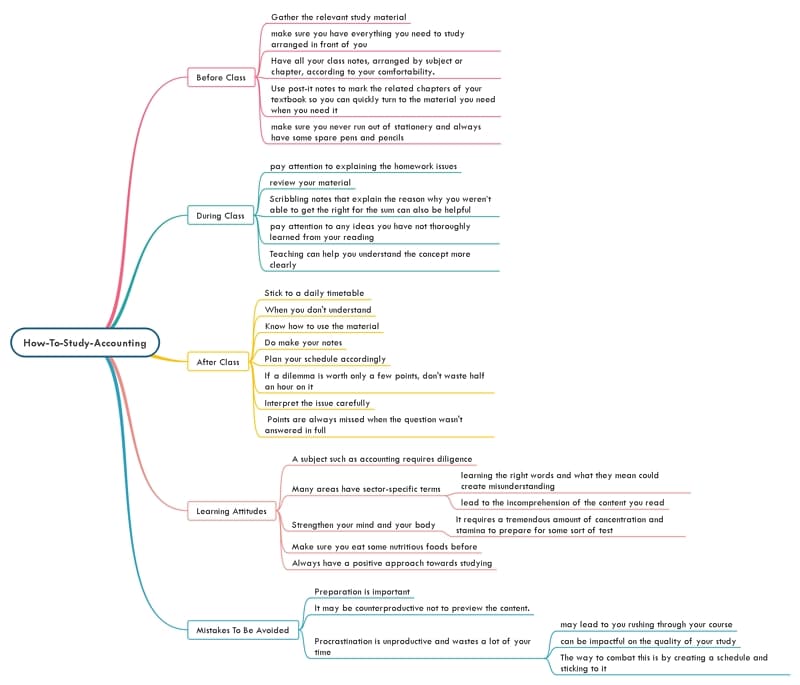

Studying accounting requires you to have a strategy, the correct mindset, and consistency.

Longer studying hours are not necessary; what you need is to study effectively. Pick up on these easy tips to help you maintain your studying, both organized and focused.

Before Class

There are many things to do before class to ensure a comfortable studying experience. Some of them are -

- Gather the relevant study materials and ensure everything you need is arranged in front of you, so you don't have to delay your studies to find resources.

- Have all your class notes, arranged by subject or chapter, according to your comfort level.

- Use post-it notes to mark your textbook’s related chapters so you can quickly turn to the material you need when you need it.

- Also, make sure you never run out of stationery and always have some spare pens and pencils.

Accounting does not require you to memorize key concepts and formulas to achieve better results. However, it needs you to consider ‘why’ a particular concept is the way it is.

Accounting is all about the ‘why.’ Explore the why behind what you are reading when you read your textbook. The primary aim is to understand the logic.

During Class

Throughout the class, pay attention to explaining the homework issues to the professor. If the homework responses do not fit your answers, review your material and figure out why that was the case.

Scribbling notes that explain why you weren’t able to get the right answer for the sum can also be helpful.

Furthermore, pay attention to any ideas you have not thoroughly learned from your reading or something the professor has mentioned that has not been included in the text.

Don't be shy about posing questions about things you don't understand. Teaching can also help you understand the concept more clearly.

After Class

During the examination period, many students face difficulties. Sometimes this is caused by insufficient planning for the exam or no training at all. How you prepare for this test is as critical as the assessment itself.

By following the tips below, you can prevent undue tension on the exam:

- Stick to a daily timetable

- When you don't understand, ask for help

- Know how to use the material

- Do make your notes

Concentrate on learning — not memorizing. Your teacher needs to see that you are thoroughly learning the accounting rules and topics learned in the course definition. This way, you know how to study accounting easily.

Key things To keep in Mind During an Exam:

- Plan your schedule accordingly.

- If a dilemma is worth only a few points, don't waste half an hour on it (regardless of how excellent the solution is, only those few points will always be worth it).

- Interpret the issue carefully. Points are always missed when the question wasn't answered in full.

Common Mistakes To Be Avoided

Preparation is important. All the material learned throughout the course is relevant, and understanding how it all works together can significantly influence your interaction with the material during this period.

It may be counterproductive not to preview the content. Often, people realize that taking the right notes benefits them in the long run for review and analysis.

Procrastination is unproductive and wastes a lot of your time. When you study accounting, you cannot afford to waste time. Perishing time is time you will never get back.

This may lead to you rushing through your course, which can impact the quality of your study. The way to combat this is by creating a schedule and sticking to it.

Learning Attitudes

A subject such as accounting requires diligence and hard work to keep showing positive results.

Many areas have sector-specific terms. Accounts are no different. Not learning the right words and what they mean could create misunderstanding and lead to the incomprehension of the content you read.

Strengthen your mind and your body. It requires a tremendous amount of concentration and stamina to prepare for a test.

Ensure you eat some nutritious foods before and during that will help you stay smoother and more alert.

Always have a positive approach towards studying and not treat it as something you ‘have’ to do, but instead as something you ‘want’ to do.

Use a Mind Map To Organize Topics

Forget about looking through your notes aimlessly. Create a mind map beginning with journal entries, next to ledgers, then to trial balances, and finally to financial statements.

Understanding the process through this visual helps you detect weak areas and organize your study time effectively.

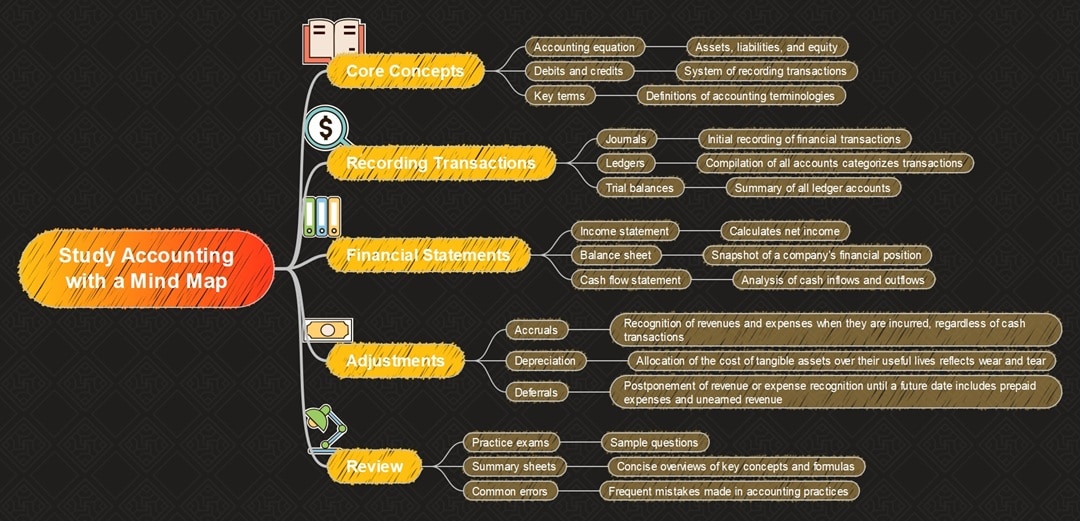

How To Boost Efficiency With a Mind Map

Accounting has layers. You learn one aspect, then move to the next, but all parts remain linked: transactions, ledgers, statements, and adjustments.

When you solely rely on outlines or write notes sequentially, it is quite difficult to uncover the relationships between concepts. With the help of a mind map, you can grasp the overall picture and understand how everything connects.

Below is a mind map demonstrating the flow of accounting studies:

Why Mind Maps Help You Study Accounting Better

You don’t have to work with each topic separately.

One mind map helps you see the connections between them visually, allowing you to follow the flow of data from one step to another. When you go over several chapters, it comes in handy.

For accounting students, this means:

- Seeing the process step by step. You can visualize how a transaction begins in journals, moves into ledgers, and ends up in financial statements.

- Strengthening recall. The layout gives you visual cues, which makes it easier to remember formulas and procedures.

- Highlighting weak spots. Revisiting the mind map, you will quickly identify the topics that require you to review.

- Saving review time. Rather than shuffling through multiple chapters, you can concentrate on one mind map that outlines the essential aspects.

- Linking theory to real-world use. Mind maps can help you connect textbook terms with their application in business scenarios.

How To Use a Mind Mapping Tool

To build your own map, start with a central topic such as “Accounting Process,” then branch out based on your current lessons.

Add short descriptions or reminders under each node. You can also color-code sections or add icons to mark areas that need review.

Some mind mapping tools also allow you to attach notes, track dates, or collapse sections so you’re not overwhelmed. These features help you focus on learning, not just organizing.

At this point, you may want to create your mind map digitally. Free options are available online, but some tools stand out for knowledge management.

You can try Wondershare EdrawMind. It lets you create visual outlines, add notes, and plan your study schedule easily, and more.

Why Mind Map Is the Perfect Resource?

Mind maps are a great way to help you study accounting. EdrawMind can be used to simplify studying accounting. Here’s why:

This easy-to-use, flexible mind mapping tool is designed to help you generate modern and fresh visuals. By combining your accounting concept’s bullet points into a mind map, EdrawMind allows you to organize the concepts and create a study map.

EdrawMind can also help you map out concepts and create a schedule for your study. It is incredibly resourceful when thinking about the logic of a problem.

Final Thoughts

Accounting is a discipline that requires both theory and experience to operate with ease and conviction regularly.

There is a wide range within the accounting sector: financial accounting, public accounting, tax preparation, etc. Whatever industry you choose, putting these ideas into effect will help you have a better career.

With EdrawMind, you can quickly turn the accounting process into a map.

The software offers 12 different map types, 33 themes, and over 700 clip art materials to design mind maps with almost unlimited possibilities. This way, you learn how to study accounting easily.

-

What Is the Difference Between Bookkeeping and Accounting?

Bookkeeping means recording a business’s daily transactions, like sales, expenses, and payments. It’s the starting point of tracking money.

Accounting takes this data, turns it into financial reports, and helps make sense of the numbers. Bookkeeping provides the input, and economic analysis is the output. -

What Are the Three Golden Rules of Accounting?

The three golden rules help guide how every transaction is recorded. For real accounts, you debit what comes in and credit what goes out.

For personal accounts, you debit the receiver and credit the giver. And for nominal accounts, you debit all expenses and losses, and credit all incomes and gains. -

What Should You Learn First in Accounting?

Learn double-entry bookkeeping first. It means recording a debit and a credit for every transaction to keep the accounting equation balanced. Once you understand that, you'll have an easier time working with journals, ledgers, and reports. -

How Do You Read Financial Statements?

You’ll be working with three key reports: the balance sheet, income statement, and cash flow statement.

Look for patterns across time and use ratios, including the current ratio and debt-to-equity, to compare numbers. These provide you with a full view of how the business is doing. -

Can You Learn Accounting in Three Months?

Yes, it's possible to learn the basics of accounting in three months. You’ll likely be able to handle simple bookkeeping or entry-level tasks. But becoming a pro takes more time, a degree, and hands-on experience.