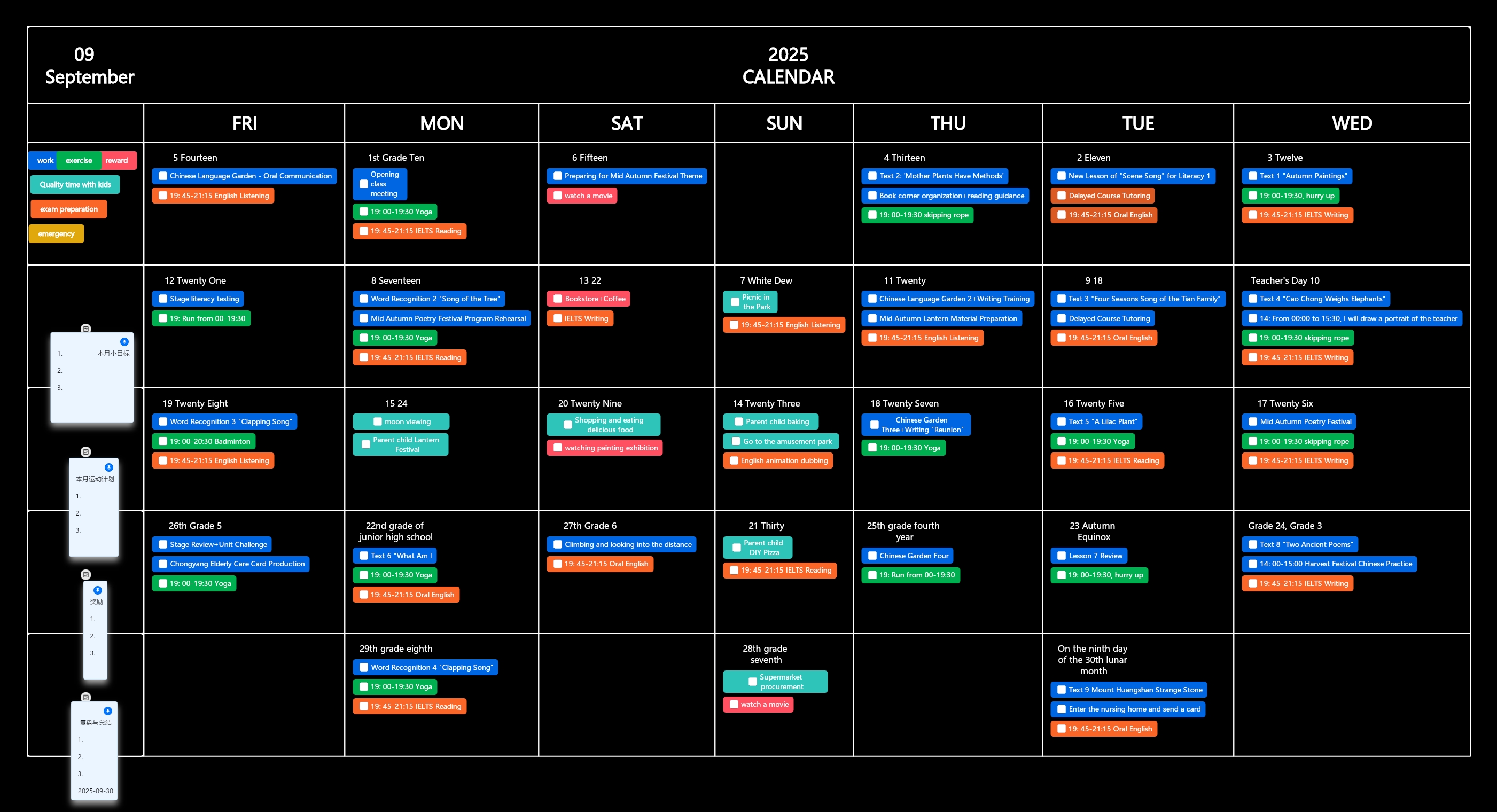

About this 2026 fiscal year calendar

This template provides a comprehensive overview of the 2026 fiscal year. It highlights critical economic events, central bank interest rate meetings, and international conferences. Organizations can use it to align their financial strategies with global market movements.

First Quarter (January - March)

The first quarter of 2026 focuses on major tech events and initial interest rate assessments. Key summits like Davos and CES set the tone for the global economy and innovation for the rest of the year.

- CES (Consumer Electronics Show)

- World Economic Forum Annual Meeting (Davos)

- Federal Reserve Interest Rate Meetings

- Bank of Japan and Bank of England Meetings

- NVIDIA GTC 2026

Second Quarter (April - June)

Q2 is packed with significant investment summits and banking meetings. Financial leaders gather for IMF and World Bank sessions, while major tech companies like Google host cloud events to showcase new enterprise solutions.

- IMF/World Bank Spring Meetings

- HSBC Global Investment Summit

- Google Cloud Next 2026

- Berkshire Hathaway Annual Shareholders Meeting

- Consensus Miami 2026

- FT Global Board Summit

Third Quarter (July - September)

During the third quarter, the focus remains on monetary policy and earnings season. Central banks continue to review interest rates regularly. This period is crucial for analyzing mid-year performance and adjusting long-term corporate budgets.

- FT Global Board Summit

- Quarterly Earnings Seasons

- ECB Interest Rate Announcements

- Federal Reserve Policy Meetings

- Bank of England and Bank of Japan Reviews

Fourth Quarter (October - December)

The final quarter of 2026 includes the U.S. midterm elections and major fintech festivals. Companies finalize their yearly audits and prepare for the next fiscal cycle while monitoring significant shifts in political leadership.

- U.S. Midterm Elections (November)

- Singapore FinTech Festival 2026

- Bloomberg New Economy Forum

- TOKEN2049 Singapore

- IMF/World Bank Annual Meetings

- International Financial Leaders Investment Summit

FAQs about this Template

-

Why is a fiscal year calendar important for businesses?

A fiscal year calendar helps businesses align their internal financial tracking with external economic events. It ensures that accounting departments meet tax deadlines and budgeting goals. By identifying key central bank meetings and summits, companies can anticipate market volatility. This foresight allows leadership to make informed decisions regarding investments and resource management, ultimately protecting the organization’s long-term financial health.

-

How do central bank meetings affect the 2026 fiscal plan?

Central bank meetings are critical because they determine interest rates, which directly impact borrowing costs and inflation. In 2026, scheduled meetings for the Federal Reserve and ECB will influence corporate loan rates and consumer spending. Finance teams must track these dates to adjust their projections. Understanding these cycles helps businesses hedge against currency fluctuations and optimize their debt management strategies.

-

What are the key economic events to watch in 2026?

Significant events in 2026 include the U.S. midterm elections, which can lead to major policy changes and market reactions. Additionally, global summits like Davos and the IMF/World Bank meetings provide insights into international trade trends. Tech conferences such as CES and NVIDIA GTC highlight upcoming innovations. Monitoring these events allows businesses to adapt to political shifts and technological advancements quickly.